For the 24 hours to 23:00 GMT, the GBP fell 0.12% against the USD and closed at 1.5250.

Yesterday, the BoE’s rate-setting Monetary Policy Committee held the central bank’s key interest rate unchanged at 0.5%, maintaining it at the same level since March 2009. The panel also maintained its bond portfolio intact at £375 billion.

In other economic news, the Halifax house prices in the UK slid 0.3% MoM in February, higher than market expected drop of 0.2% and following an advance of 1.9% registered in the previous month.

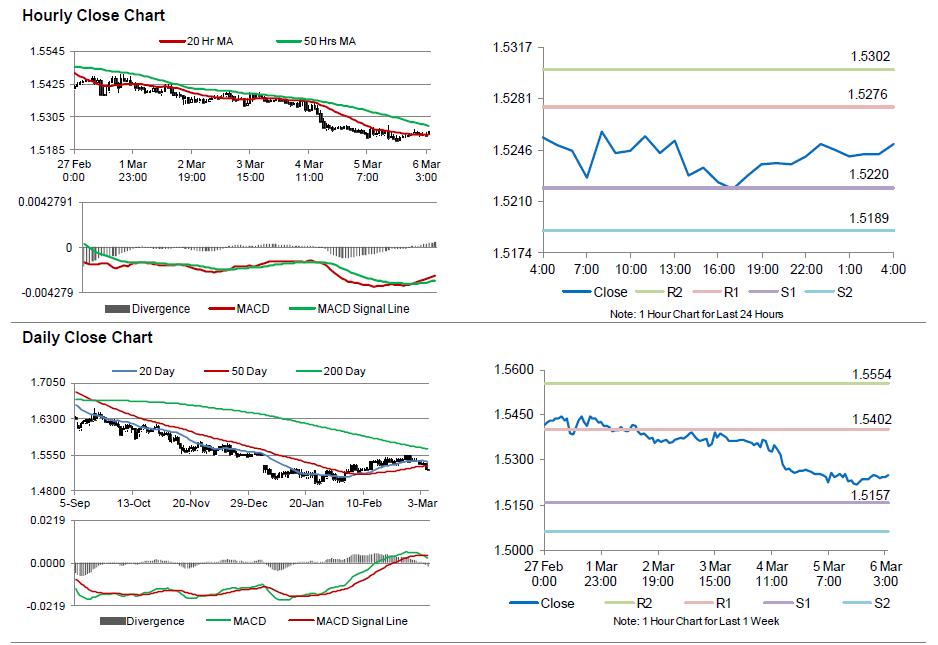

In the Asian session, at GMT0400, the pair is trading at 1.5250, with the GBP trading flat from yesterday’s close.

The pair is expected to find support at 1.5220, and a fall through could take it to the next support level of 1.5189. The pair is expected to find its first resistance at 1.5276, and a rise through could take it to the next resistance level of 1.5302.

Trading trends in the Pound today are expected to be determined by the BoE’s consumer inflation expectation survey, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.