For the 24 hours to 23:00 GMT, the EUR rose 0.44% against the USD and closed at 1.6158.

In economic news, producer prices in Germany stagnated on a monthly basis in September, following a decline of 0.1% recorded in August and compared to market expectations for a flat reading. Additionally, the seasonally adjusted current account surplus of Euro-zone contracted to €18.9 billion in August, compared to previous month’s surplus of €21.6 billion.

Elsewhere, in Italy, industrial orders as well as industrial sales rebounded sharply on a monthly basis in August.

Separately, the ECB Vice President, Vitor Constancio stated that the central bank needs to continue with its accommodative monetary policy as a situation of low inflation and fragile growth still poses a threat to the region. He also called policymakers to use insights they gain from their banking supervisory powers while determining the monetary policy.

Yesterday, the European Central Bank confirmed that it had started to buy covered bonds as part of a stimulus program to boost the Euro-zone’s economy. The central bank did not disclose the exact amount of covered bonds it purchased, however it assured that it would announce its weekly purchase amounts each Monday, starting next week.

In the US, the Dallas Fed President, Richard Fisher stated in an interview that there was no need to delay the end of the monthly bond-buying programme by the Fed and it should get over as planned, as according to him the world’s largest economy was on “on a strong trajectory” and it would continue to do well.

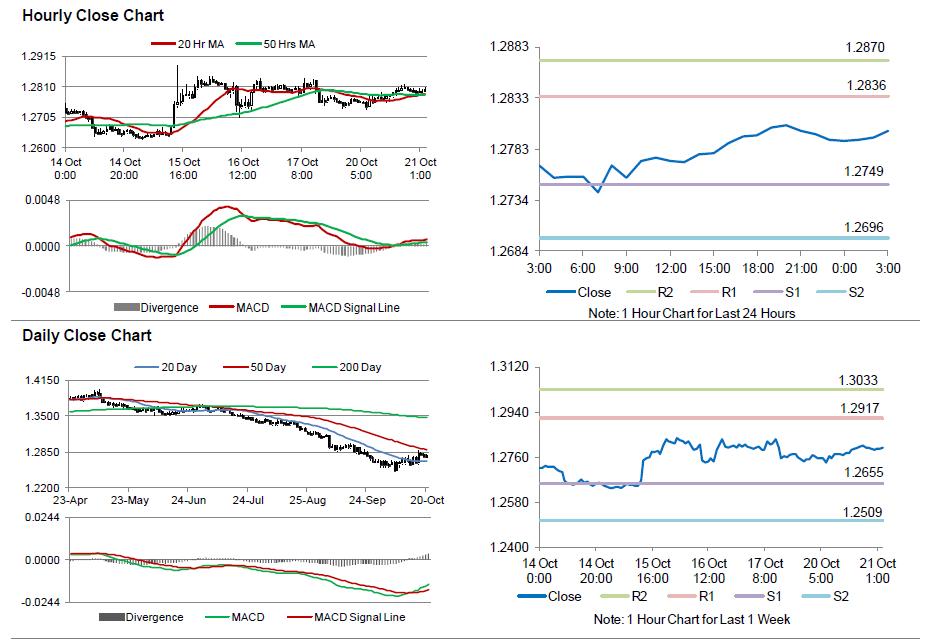

In the Asian session, at GMT0300, the pair is trading at 1.2801, with the EUR trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.2749, and a fall through could take it to the next support level of 1.2696. The pair is expected to find its first resistance at 1.2836, and a rise through could take it to the next resistance level of 1.2870.

Trading trends in the Euro today would be determined by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.