For the 24 hours to 23:00 GMT, the GBP rose 0.44% against the USD and closed at 1.6158.

Yesterday, a private survey in the UK revealed that an interest rate hike move by the BoE was very unlikely to happen in Q1 of 2015. It further reported that the Britain economy would grow by 2.4% next year, down from 3.1% forecast issued earlier by the BoE as well as the IMF.

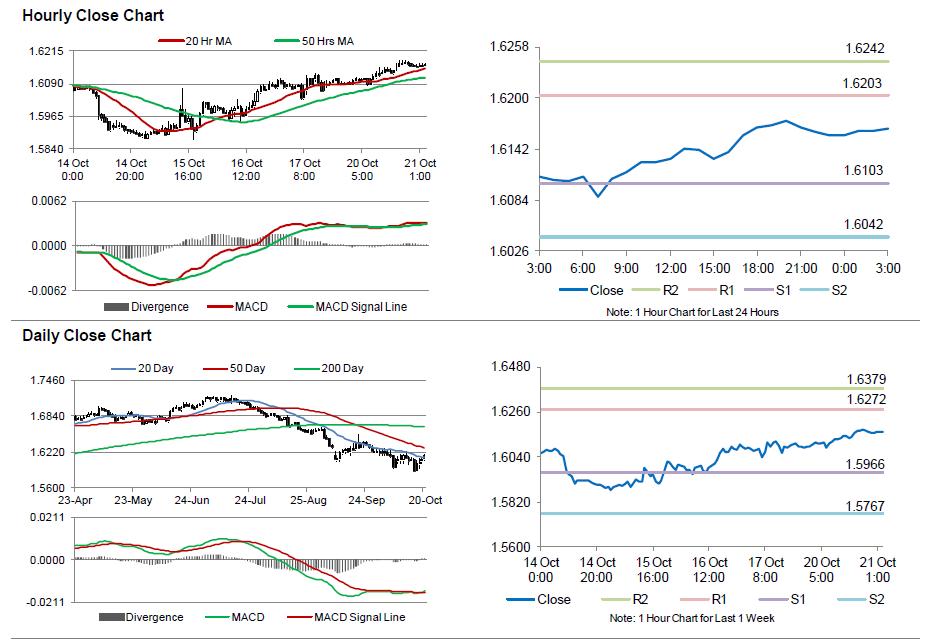

In the Asian session, at GMT0300, the pair is trading at 1.6165, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.6103, and a fall through could take it to the next support level of 1.6042. The pair is expected to find its first resistance at 1.6203, and a rise through could take it to the next resistance level of 1.6242.

Trading trends in the Pound today are expected to be determined by the UK’s public sector net borrowings data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.