For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.3361, as European Central Bank (ECB) President, Mario Draghi, cautioned that the sanctions war against Russia could worsen the economic outlook of the single currency region. Meanwhile, Russia too has retaliated by putting ban on certain imports from the US and from Europe as well. Yesterday, the ECB kept its interest rates unchanged at 0.15% and indicated that the rates would remain at the same level in view of the current outlook for inflation. The central bank also kept its deposit rate and marginal lending rate unchanged at negative 0.1% and 0.4%, respectively.

Additionally, in Germany, Euro-zone’s biggest economy, the industrial production fell short of expectations and raised concerns over its economy’s performance. The factory production in Germany increased 0.3% in June against the market expectations of 1.4% increase but after registering a 1.7% drop in the previous month. German economy ministry said that the positive trend of the nation’s industrial production would continue. Elsewhere, the trade deficit in France unexpectedly widened to 5.4 billion in June, from 5.1 billion in the preceding month.

In the US, the seasonally adjusted number of initial jobless claims dropped unexpectedly to an 8-year low by 14,000 to a level of 289.0K in the week ended 2 August 2014. Markets were anticipating the number claims to rise to a level of 304.0K. Similarly, consumer credit in the US rose by $17.255 billion in June, lower than market expectations of a rise of $18.65 billion. It had recorded a revised rise of $19.642 billion in the previous month.

In a recent key development, the US President Obama has authorized air-strikes to protect American personnel in Iraq.

In the Asian session, at GMT0300, the pair is trading at 1.3386, with the EUR trading tad higher from yesterday’s close.

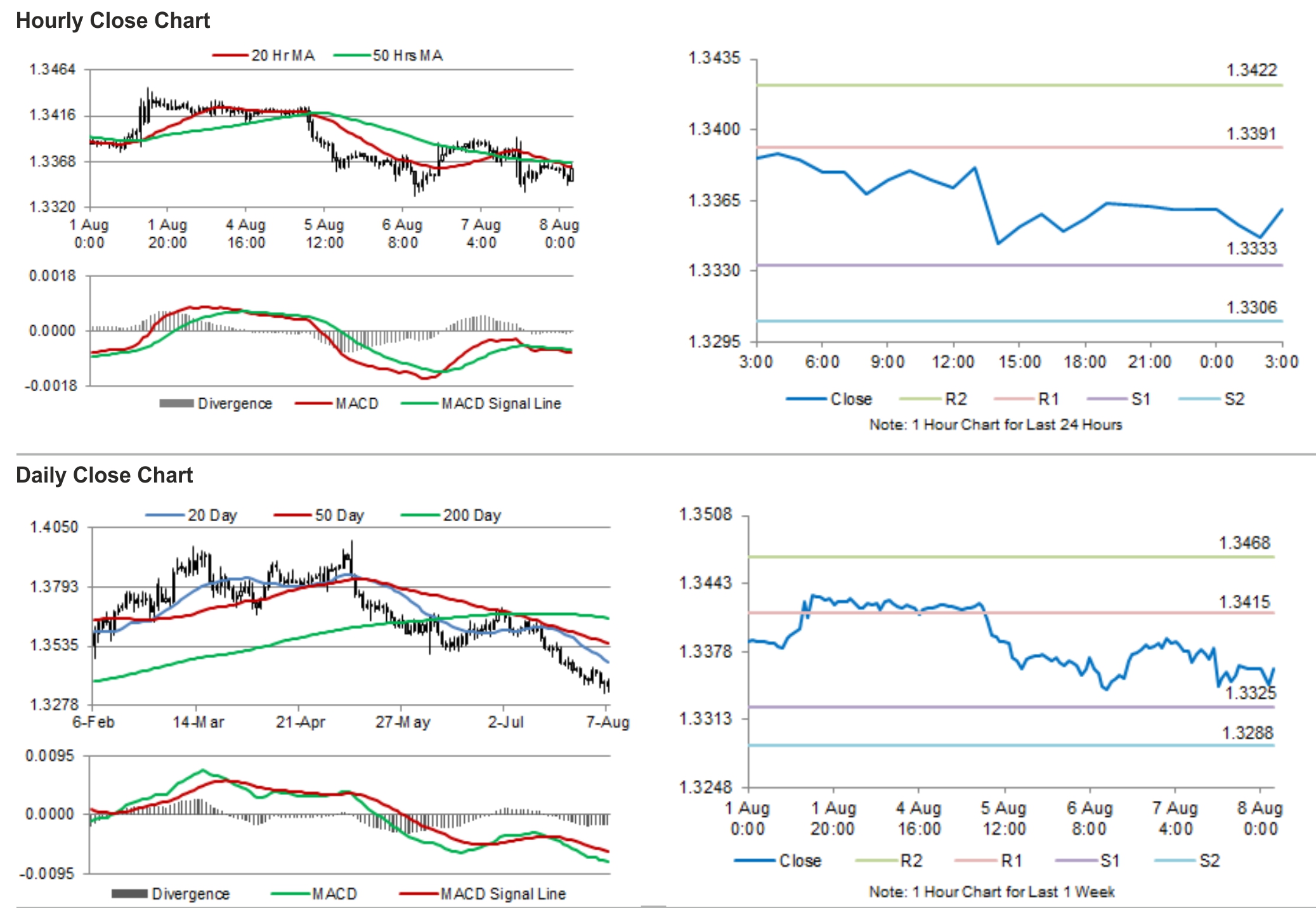

The pair is expected to find support at 1.3348, and a fall through could take it to the next support level of 1.3310. The pair is expected to find its first resistance at 1.3408, and a rise through could take it to the next resistance level of 1.3430.

Going forward, investors would be looking at German trade balance data and the French industrial output, scheduled later in the day.

The currency pair is showing convergence with both its 20 Hr and 50 Hr moving averages.