For the 24 hours to 23:00 GMT, the USD gained 0.14% against the CHF and closed at 0.9089.

On the macro level, the SECO consumer climate in Switzerland fell unexpectedly to -1.0 in Q2 2014. Markets anticipations for it were to advance to 3.0, compared to a level of 1.0 in the previous three months. Meanwhile, the Swiss foreign currency reserves surplus rose to CHF453.4 billion in July, from CHF449.6 billion a month ago.

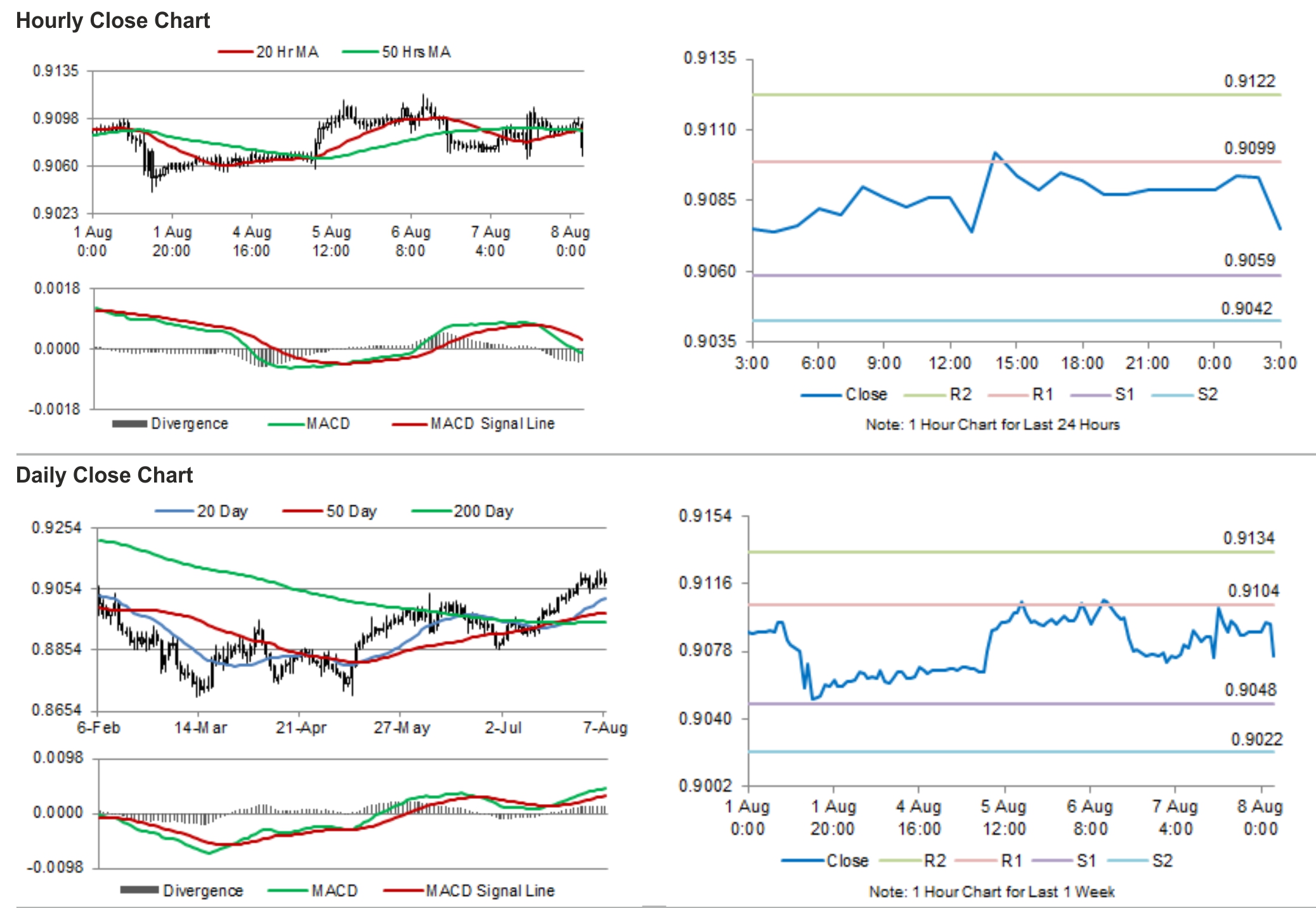

In the Asian session, at GMT0300, the pair is trading at 0.9075, with the USD trading 0.15% lower from yesterday’s close.

The pair is expected to find support at 0.9059, and a fall through could take it to the next support level of 0.9042. The pair is expected to find its first resistance at 0.9099, and a rise through could take it to the next resistance level of 0.9122.

Trading trends in the Swiss Franc today are expected to be determined by the release of Swiss employment data for July.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.