For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.1277.

The European Central Bank (ECB), in its April monetary policy meeting, decided to keep the benchmark interest rate steady at 0.00%, as widely expected, amid indications of a slowdown in the global growth momentum. The central bank indicated its plans to hold the interest level at the same level until the year end and would focus on reinvesting the principal amount from its recently ended bond-buying program. The ECB Chief, Mario Draghi stated that the possibilities of recession in the region continue to remain low.

The US dollar declined against major currencies, after the FOMC meeting minutes indicated that the policymakers expressed concerns over the global economic slowdown and diminishing effects of the tax cuts lead to a pause in its interest rate hikes. The FOMC committee expects subdued growth in the GDP as well as consumer spending and business investments.

In the US, data showed that the US consumer price index (CPI) advanced to a 14-month high level of 1.9% on an annual basis in March, compared to a rise of 1.5% in the previous month. Market participants had anticipated the CPI to rise 1.8%. Meanwhile, the nation’s mortgage applications declined 5.6% on a weekly basis in the week ended 05 April 2019, declining from a 2.5-year high level and following an advance of 18.6% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1276, with the EUR trading marginally lower against the USD from yesterday’s close.

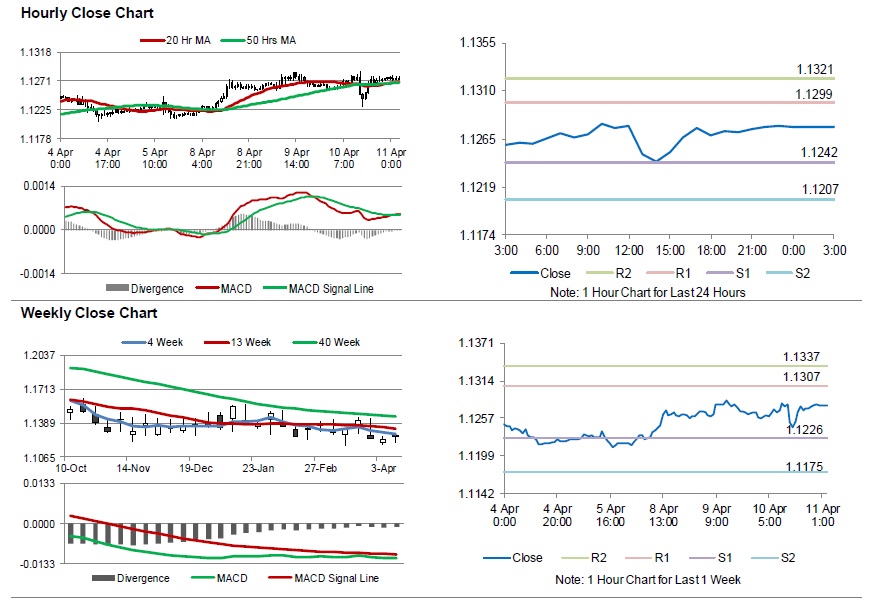

The pair is expected to find support at 1.1242, and a fall through could take it to the next support level of 1.1207. The pair is expected to find its first resistance at 1.1299, and a rise through could take it to the next resistance level of 1.1321.

Looking ahead, traders would await Germany’s consumer price index for March, set to release in a few hours. Later in the day, the US producer price index for March along with initial jobless claims, will garner significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.