For the 24 hours to 23:00 GMT, the GBP rose 0.26% against the USD and closed at 1.3090, after the EU granted a second extension for Brexit reducing the fears of a no-deal divorce.

On the data front, UK’s total trade deficit narrowed to £4.86 billion in February, lower than market expectations for a deficit of £3.79 billion. The nation had posted a revised deficit of £5.34 billion in the previous month. Moreover, Britain’s gross domestic product (GDP) unexpectedly rose 0.2% on a monthly basis in February, defying market anticipation for an unchanged reading. In the previous month, GDP had registered a rise of 0.5%.

Additionally, the nation’s manufacturing production surprisingly advanced 0.6% on an annual basis in February, notching a decade high level and compared to a revised fall of 0.7% in the preceding month. Market participants had envisaged manufacturing production to register a decline of 0.6%. Also, UK’s industrial production unexpectedly climbed by 0.1% on an annual basis in February, defying market consensus for a drop of 0.9%. In the prior month, industrial production had recorded a revised drop of 0.3%.

In the Asian session, at GMT0300, the pair is trading at 1.3097, with the GBP trading 0.05% higher against the USD from yesterday’s close.

Overnight data showed that Britain’s RICS house price balance unexpectedly improved to -24.00 in March, rising for the first time in 8-months and defying market expectations of a drop to -29.00. In the prior month, house price balance had registered a revised reading of -27.00.

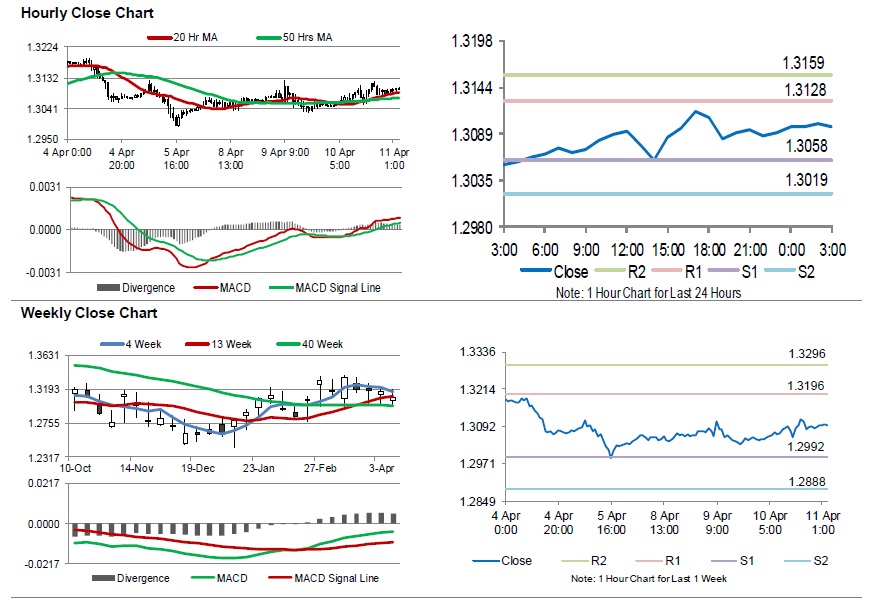

The pair is expected to find support at 1.3058, and a fall through could take it to the next support level of 1.3019. The pair is expected to find its first resistance at 1.3128, and a rise through could take it to the next resistance level of 1.3159.

With no macroeconomic releases in the UK today, investors would look forward to global macroeconomic releases for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.