For the 24 hours to 23:00 GMT, the EUR declined 0.7% against the USD and closed at 1.0626.

According to minutes of the European Central Bank’s (ECB) most recent meeting, policymakers were ready to boost their €1.7 trillion stimulus again, if needed to ensure that Euro-zone’s economy remains on its recovery path. Further, it revealed that board members widely agreed to wait until December to get a clearer picture of the inflation outlook to form a policy view as they found it premature to make a firm assessment of the outlook for price stability and to discuss its implications. Minutes also showed that policy makers expressed concerns that underlying inflation “still lacked a convincing upward trend.”

In other economic news, data revealed that Euro-zone’s consumer price index rose less-than-expected by 0.2% on a monthly basis in October, compared to market expectations for an advance of 0.3% and following a rise of 0.4% in the previous month. Meanwhile, the nation’s seasonally adjusted construction output eased by 0.9% on a monthly basis in September, declining for the first time in six months. In the prior month, construction output had climbed by a revised 0.1%.

The US Dollar gained ground against most of its key counterparts, after hawkish comments from the Federal Reserve (Fed) Chairwoman, Janet Yellen and upbeat economic data, boosted the case for a Fed interest rate hike in December.

Yesterday, Janet Yellen, in a testimony to the Joint Economic Committee, strongly signalled that the Fed could raise interest rates “relatively soon”, as the US economy is showing signs of continuous improvement. Further, she noted that holding off on a rate hike for too long could force the Fed to raise rates abruptly in the future to keep the economy from overheating. However, she reiterated that the central bank expects to tighten monetary policy gradually over the next few years.

Another set of economic data revealed that, the US consumer price index climbed by 0.4% MoM in October, meeting market expectations and recording its biggest rise in six months, thus suggesting that inflation is moving up towards central bank’s 2.0% target. The CPI had recorded an advance of 0.3% in the prior month. Additionally, the nation’s initial jobless claims unexpectedly dropped to a level of 235.0K in the week ended 12 November, hitting its lowest level in four decades and pointing to continuous strength in the labour market. Initial jobless claims recorded a reading of 254.0K in the previous week while investors had envisaged for it to rise to a level of 257.0K. Moreover, the nation’s housing starts surged to a more than nine-year high, after it increased more by 25.5% on monthly basis in October, to an annual rate of 1323.0K, compared to a revised level of 1054.0K in the previous month and beating market expectations for it to advance to a level of 1156.0K. Further, the nation’s building permits surprisingly rose by 0.3% on a monthly basis, to an annual rate of 1229.0K in October, compared to a reading of 1225.0K in the prior month whereas markets expected building permits to fall to a level of 1195.0K.

In the Asian session, at GMT0400, the pair is trading at 1.0604, with the EUR trading 0.21% lower against the USD from yesterday’s close.

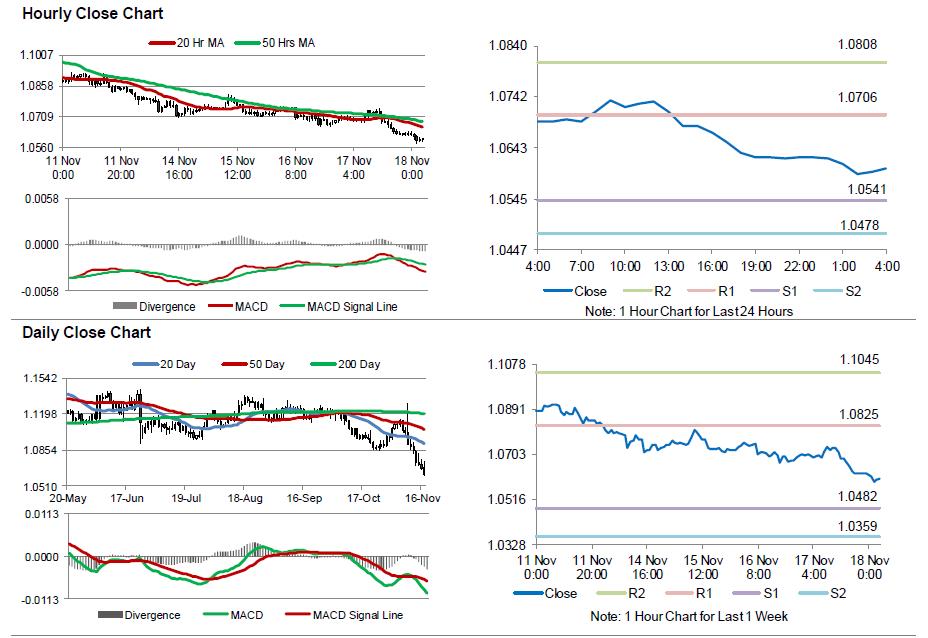

The pair is expected to find support at 1.0541, and a fall through could take it to the next support level of 1.0478. The pair is expected to find its first resistance at 1.0706, and a rise through could take it to the next resistance level of 1.0808.

Moving ahead, all eyes would be on a speech by the ECB President, Mario Draghi, slated to release in a few hours. Additionally, in the US, the CB leading indicator index for October, due to release later today, would be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.