For the 24 hours to 23:00 GMT, the GBP declined 0.19% against the USD and closed at 1.2417.

Data indicated that, UK’s annualised retail sales increased at the fastest pace in more than fourteen years, after it jumped by 7.4% in October, thus increasing scope for the Bank of England (BoE) to gradually move away from its easing-cycle. Meanwhile, markets expected retail sales to rise by 5.3%, following a revised gain of 4.2% in the previous month. Further, on a monthly basis, retail sales climbed by 1.9% in October, notching its three-month high level and surpassing market expectations for an advance of 0.5%. Retail sales had climbed by a revised 0.1% in the prior month.

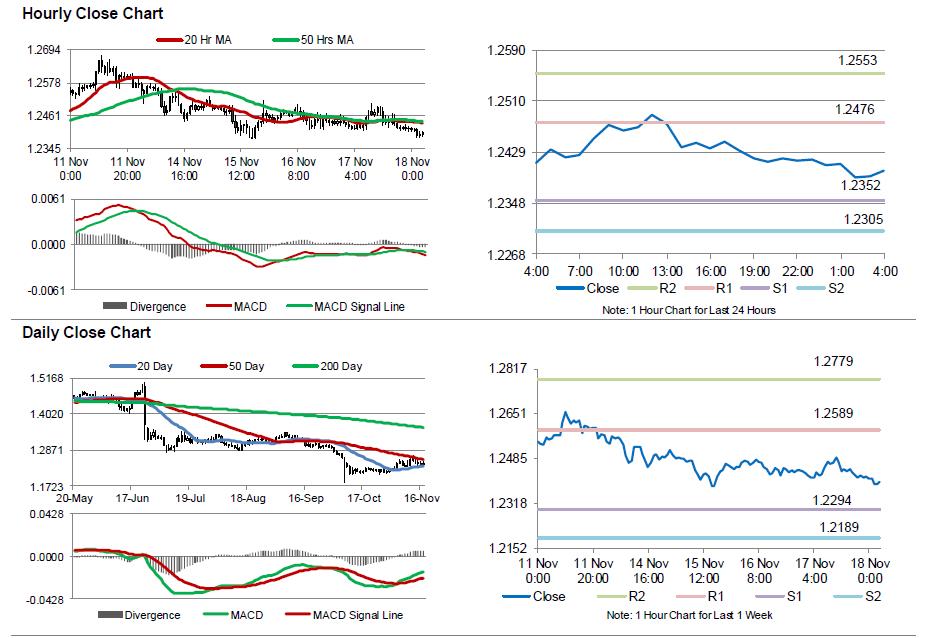

In the Asian session, at GMT0400, the pair is trading at 1.24, with the GBP trading 0.14% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2352, and a fall through could take it to the next support level of 1.2305. The pair is expected to find its first resistance at 1.2476, and a rise through could take it to the next resistance level of 1.2553.

With no economic releases in UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.