For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.3831, after the CESifo Group reported that its index on Germany’s business climate and future economic expectations unexpectedly rose to a reading of 111.2 and 107.3, respectively in April. However, the Euro-zone’s common currency pared some its initial gains after the ECB President, Mario Draghi highlighted the central bank’s willingness to start broad-based assets purchases if inflation outlook in the region worsens further. Additionally, Mr. Draghi projected inflation rate in the Euro-zone economy to remain low for a prolonged period of time before rising back to 2% while warning that a stronger Euro could derail the fragile economic recovery in the region and would also impact the central bank’s policy stance.

Separately, another ECB Governing Council member, Luc Coene stated that a lower-than-expected April inflation reading in the region would persuade the central bank to take some stringent measures, further suggesting that any next move could mean negative rates on the deposit facility.

Meanwhile, in the US, durable goods orders rose more-than-expected 2.6% in March, the biggest jump since November 2013 while the number of people claiming jobless benefits rose by 24,000 numbers to a seasonally adjusted 329,000 for the week ended 18 April 2014.

In the Asian session, at GMT0300, the pair is trading at 1.3835, with the EUR trading slightly higher from yesterday’s close.

In a noteworthy event, Fitch Ratings upgraded its rating outlook on Italy’s “BBB+” long-term foreign and local currency issuer default ratings to “Stable” from “Negative.”

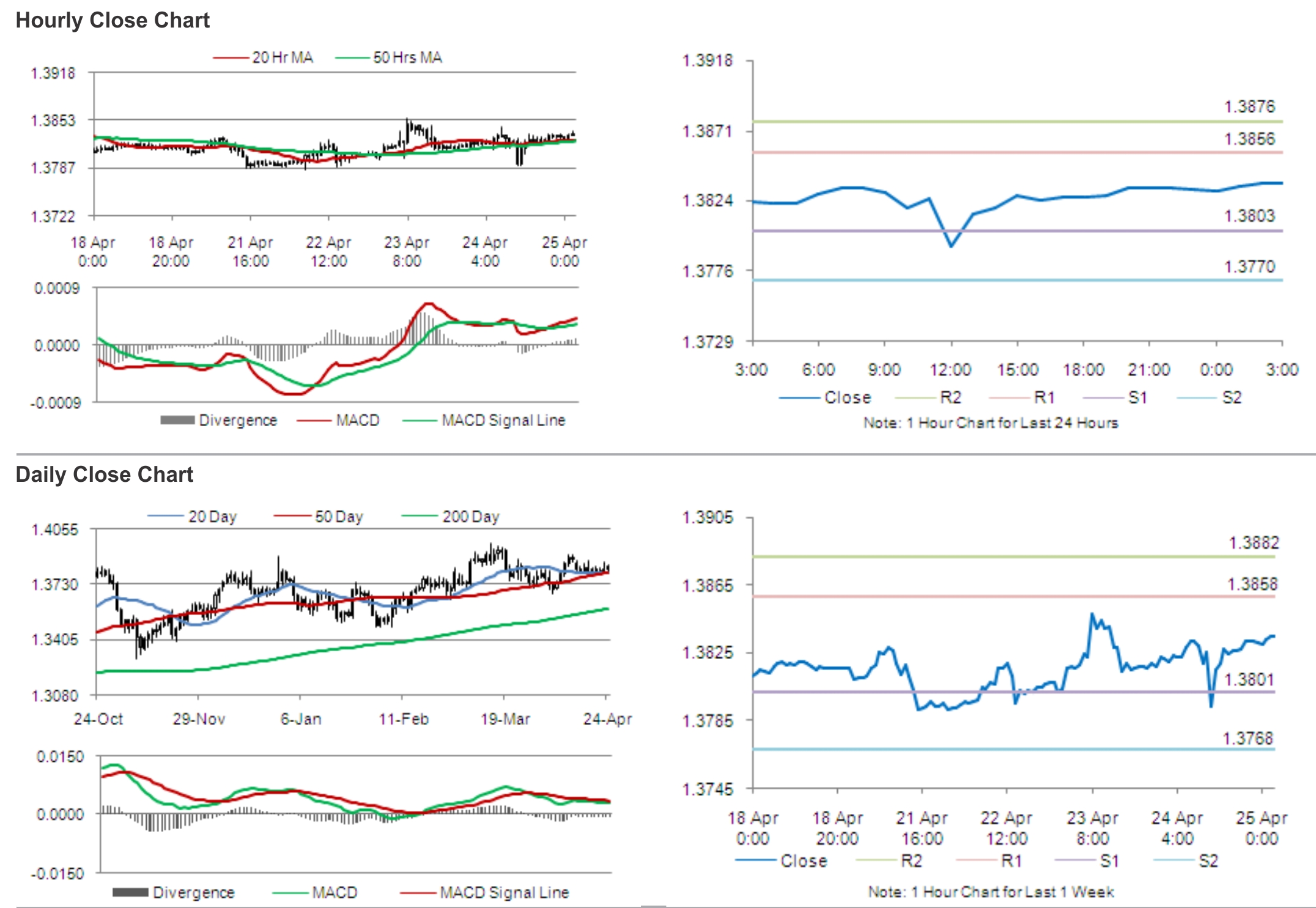

The pair is expected to find support at 1.3803, and a fall through could take it to the next support level of 1.3770. The pair is expected to find its first resistance at 1.3856, and a rise through could take it to the next resistance level of 1.3876.

Amid lack of major economic releases in the Euro-zone, later today, traders would eye global economic news as well as the US consumer sentiment data and Markit services PMI data, for further cues in the currency pair.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.