For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.6808, after the Confederation of British Industry (CBI), in its distributive trades survey, reported that retail sales in the UK grew more-than-expected to a level of 30.0% in April, its highest level since February and compared to a reading of 13.0% reported in the previous month. Meanwhile the CBI executives stated that the upbeat report indicates the positive sentiment surrounding the UK economy at present and now the nation should aim at making this “a consistent theme”.

Furthermore, during the day a strong US durable goods orders data capped the UK Pound’s gains against the US Dollar. However, a separate report indicating a rise in number of US citizens claiming jobless benefits weighed on the greenback.

In the Asian session, at GMT0300, the pair is trading at 1.6804, with the GBP trading tad lower from yesterday’s close.

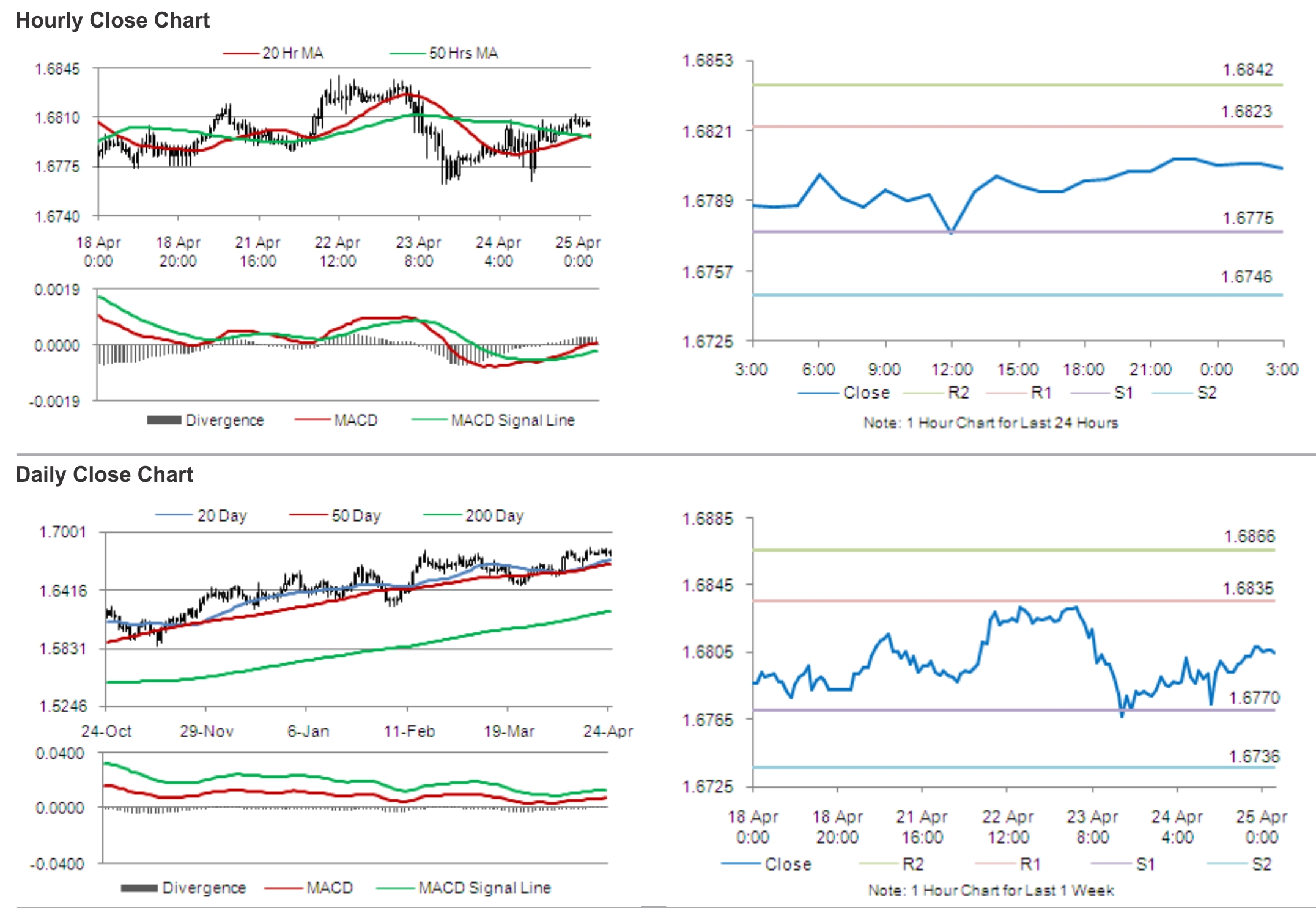

The pair is expected to find support at 1.6775, and a fall through could take it to the next support level of 1.6746. The pair is expected to find its first resistance at 1.6823, and a rise through could take it to the next resistance level of 1.6842.

Traders keenly await the UK’s retail sales and BBA mortgage approval data, due later today, for further cues in the British Pound.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.