For the 24 hours to 23:00 GMT, the EUR declined 0.10% against the USD and closed at 1.3533, as dovish comments by few top ECB policymakers weighed on traders’ risk-taking appetite. An ECB policymaker, Ardo Hansson, opined that the central bank should mull over QE options and keep such “options on the shelf for possible use.” Additionally, another ECB official, Yves Mersch hinted that the ECB could purchase “simple and transparent” asset-backed securities to enable the Euro-zone achieve its price stability target. Separately, France’s Finance Minister, Michel Sapin, applauded ECB’s last week decision while projecting that these “extremely innovative and completely exceptional decisions” would prove a boon for his nation’s economic growth. However, in a television interview, ECB’s Christian Noyer, highlighted the need for Euro-zone’s member nations’ governments to do their part in promoting investment and employment in the region and not just depend on the ECB’s policy action.

Meanwhile, in the US, an official report showed that the nation’s budget deficit shrank more than 6.0% to $130.0 billion in May. Economists had expected a $131.0 billion deficit last month.

In a noteworthy event, the World Bank, citing concerns over Ukraine crisis, slashed its forecast on global economic growth to 2.8% this year, compared to its prior forecast of 3.2% made in January. Additionally, the Washington-based lender also trimmed its growth forecast for the US to 2.1% from 2.8%, noting the extremely harsh winter in the nation at the start of the year. However, the bank, in its semi-annual report, projected the Euro-zone economy to continue to expand at a pace of 1.1%.

In the Asian session, at GMT0300, the pair is trading at 1.3543, with the EUR trading 0.07% higher from yesterday’s close.

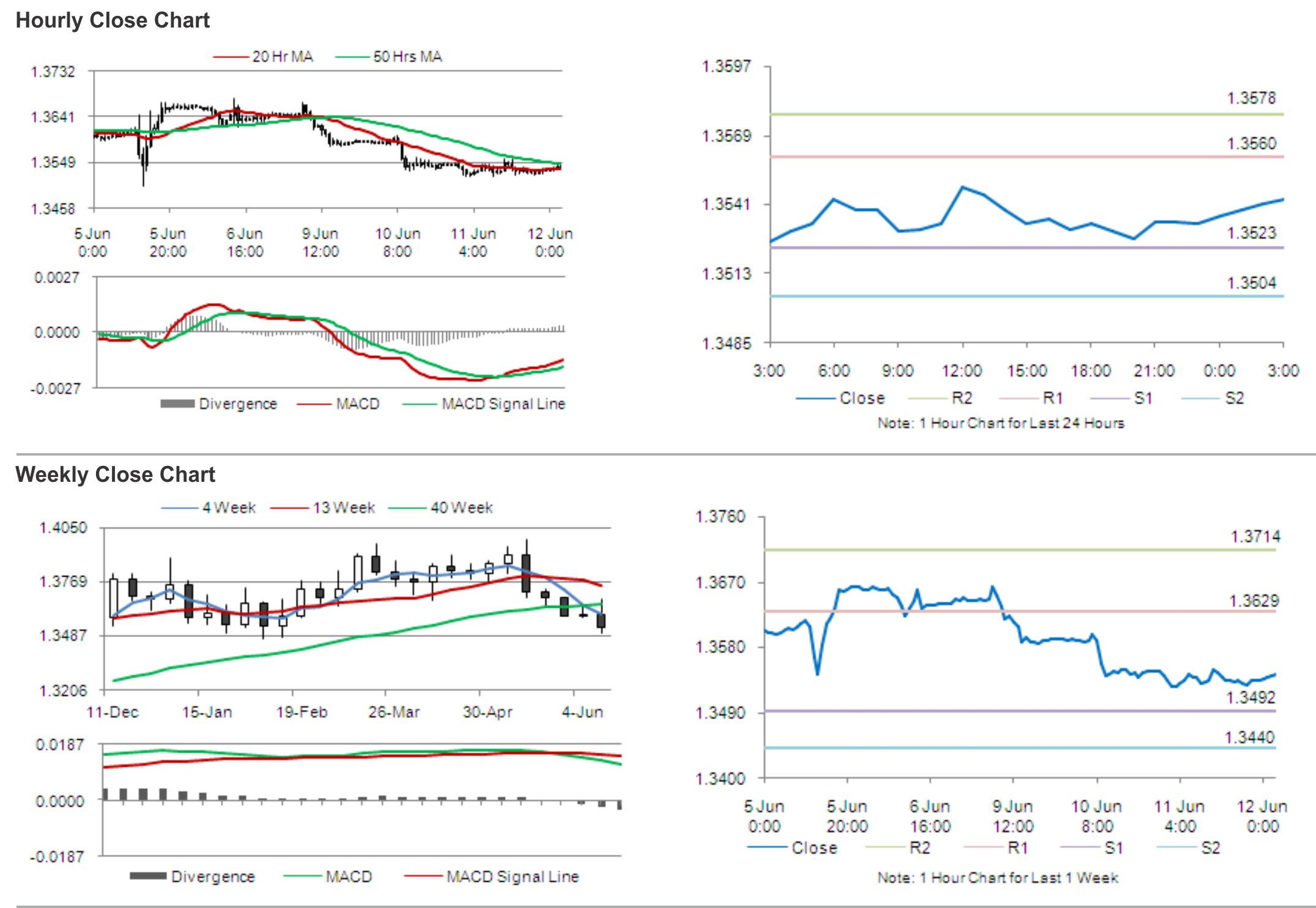

The pair is expected to find support at 1.3523, and a fall through could take it to the next support level of 1.3504. The pair is expected to find its first resistance at 1.3560, and a rise through could take it to the next resistance level of 1.3578.

During the later course of the day, traders would keenly eye Euro-zone’s industrial production and ECB’s monthly report, along with US’s retail sales and weekly jobless claims data, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.