For the 24 hours to 23:00 GMT, the GBP rose 0.21% against the USD and closed at 1.6790, as the ILO unemployment rate in the UK economy fell more than economists’ expectation to 6.6%, the lowest level in more than five years, while employment rose by 345,000, the biggest increase since 1971, in the three months ended April. Separately, the number of jobless claims in the nation fell 27,400 in May, the 19th straight declined, bringing the claimant-count rate to 3.2%, the lowest since October 2008. However, during the Treasury Committee hearing, a BoE policymaker, Ben Broadbent, acknowledged that UK housing market remained a threat to economic stability of the country while suggesting that the recent housing market upturn in the UK bore little resemblance to the debt-fuelled booms of the past.

In the Asian session, at GMT0300, the pair is trading at 1.6798, with the GBP trading slightly higher from yesterday’s close.

Earlier today, a monthly survey report from the RICS, showed that the net house price balance in the UK rose to a level of 57.0% in May, contradicting analysts’ call for a decline to 52.0% from previous month’s level of 55.0%.

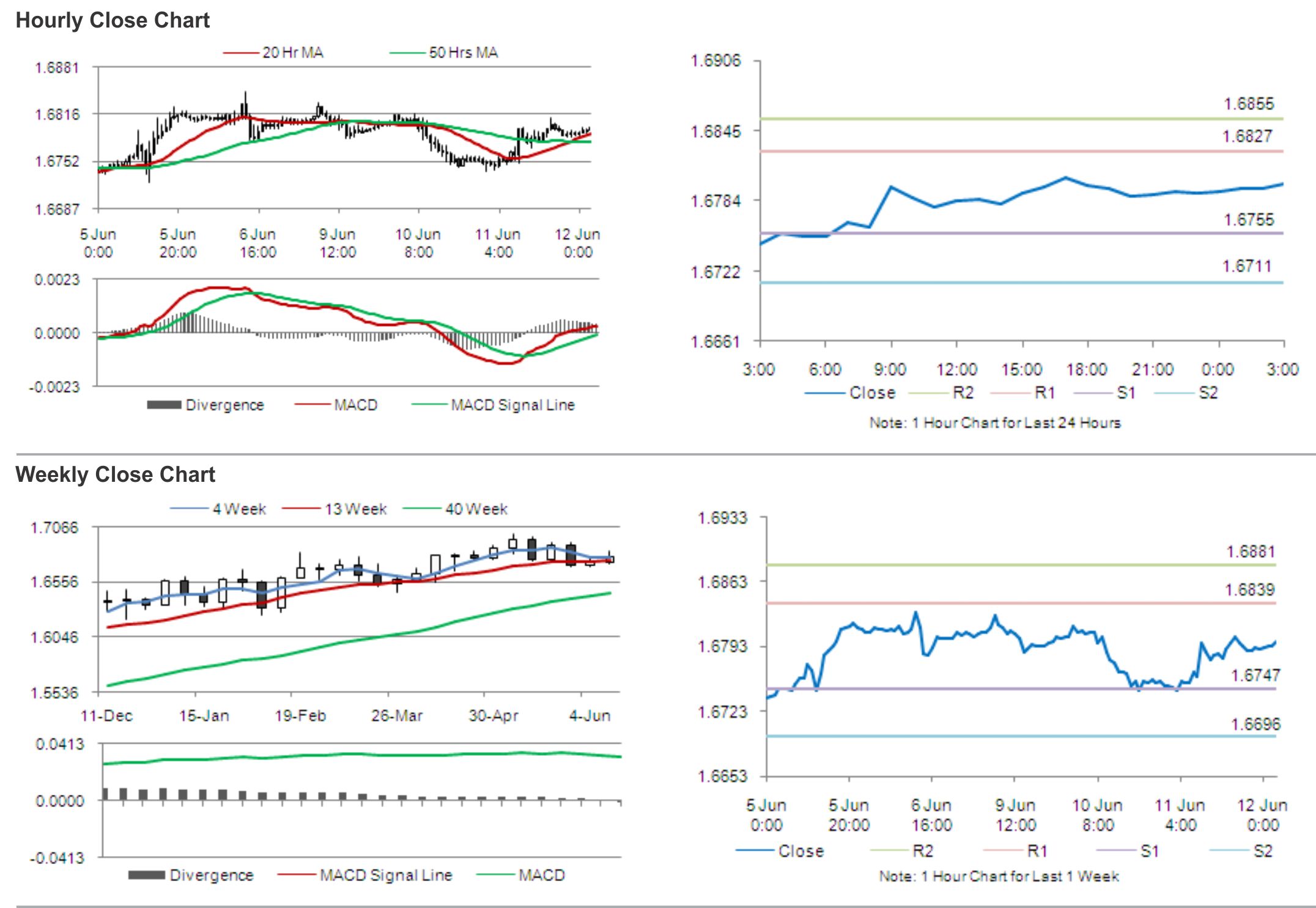

The pair is expected to find support at 1.6755, and a fall through could take it to the next support level of 1.6711. The pair is expected to find its first resistance at 1.6827, and a rise through could take it to the next resistance level of 1.6855.

Traders keenly look forward to a planned speech from the BoE Governor, Mark Carney, later today, for further cues in the Pound.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.