For the 24 hours to 23:00 GMT, EUR declined 0.08% against the USD and closed at 1.3731, as traders refrained from taking major bets in the Euro-bloc’s common currency ahead of the ECB interest rate decision. Negative sentiment for the Euro was also fuelled after the IMF suggested the central bank to slash it benchmark interest rate and look for more ways to inject more money in the economy by considering various options such as its LTRO programme or QE measure to avert deflation threats to the region.

In economic news, on a seasonally adjusted basis, the Euro-zone’s GDP rose 0.5% (YoY) in the fourth quarter, broadly in-line with preliminary estimates and after dropping 0.3% in the previous quarter. Meanwhile, retail sales in the Euro-bloc rose 1.6% (MoM) in January, more than market estimates and compared to a revised 1.3% drop recorded in the previous month. Separately, Markit Economics reported that its services and composite PMI for the Euro-zone advanced more than market forecast to a reading of 52.6 and 53.3, respectively in February. Likewise, Germany’s Markit services PMI also registered an upbeat rise in February but the Markit services PMI for France declined in the previous month.

In the US, the Fed Beige Book revealed that severe winter weather in the nation has overshadowed the economy’s growth. However, eight of the twelve regions managed to depict a “modest to moderate” improvement due to comparatively strong job market and real estate activities. Meanwhile, the Fed Chair, Janet Yellen vowed to give maximum attention to jobs and stable prices, in order to boost economic growth in the nation, which, according to her, is considerably short of the Congress-mandate goals. Separately, the ISM non-manufacturing PMI declined more-than-expected to a reading of 51.6 in February, from previous month’s level of 54.0 while the ADP employment report showed that the nation’s private sector added 139,000 jobs in February, less than analysts’ expectations and compared to 127,000 jobs added in the previous month.

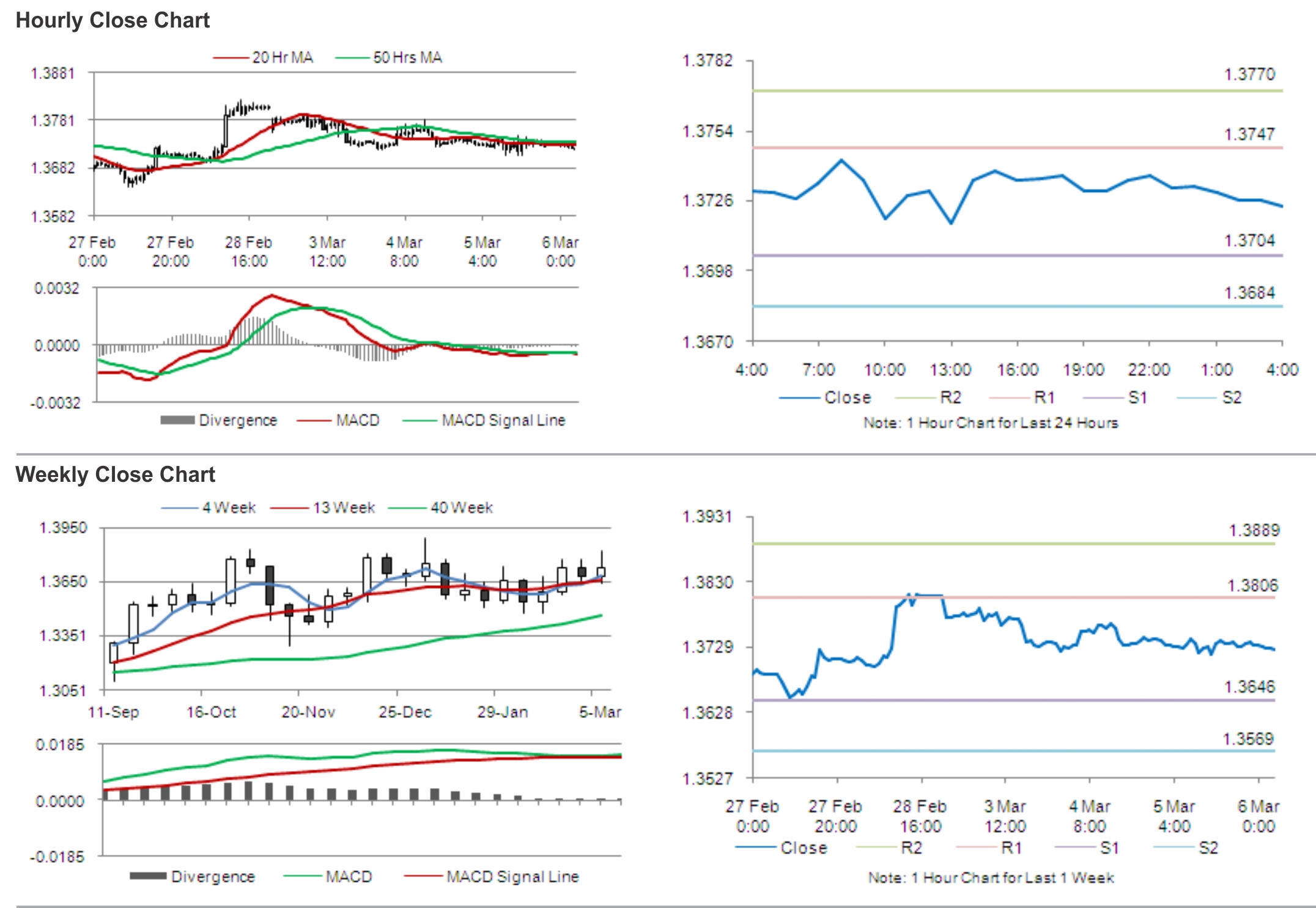

In the Asian session, at GMT0400, the pair is trading at 1.3724, with the EUR trading marginally lower from yesterday’s close.

Early morning, the San Francisco Fed President, John William expressed optimism on the growth-outlook of the US economy by stating that economy would continue to grow at 2.5% or more and unemployment rate in the nation would fall to a more “normal level,” between 5% and 6% over the next few years.

Separately, the Dallas Fed Chief, Richard Fisher indicated that the central bank is focusing on managing its exit from loose monetary policy without fanning inflation. Furthermore, he opined that the US Fed’s QE measure has “overstayed its welcome” and that as a result it is now distorting financial markets and encouraging risk-taking.

The pair is expected to find support at 1.3704, and a fall through could take it to the next support level of 1.3684. The pair is expected to find its first resistance at 1.3747, and a rise through could take it to the next resistance level of 1.3770.

Traders keenly await the ECB’s interest rate decision, due later today, for further guidance in the Euro.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.