For the 24 hours to 23:00 GMT, GBP rose 0.30% against the USD and closed at 1.6715, as traders reacted positively to a less-than-expected fall in the UK Markit service PMI data. The Markit Economics reported that its service PMI in the UK edged lower to a reading of 58.2 in February, the lowest level in three months, from a figure of 58.3 registered in the previous month. Analysts had expected the Markit service PMI to fall to a reading of 58.0 in February.

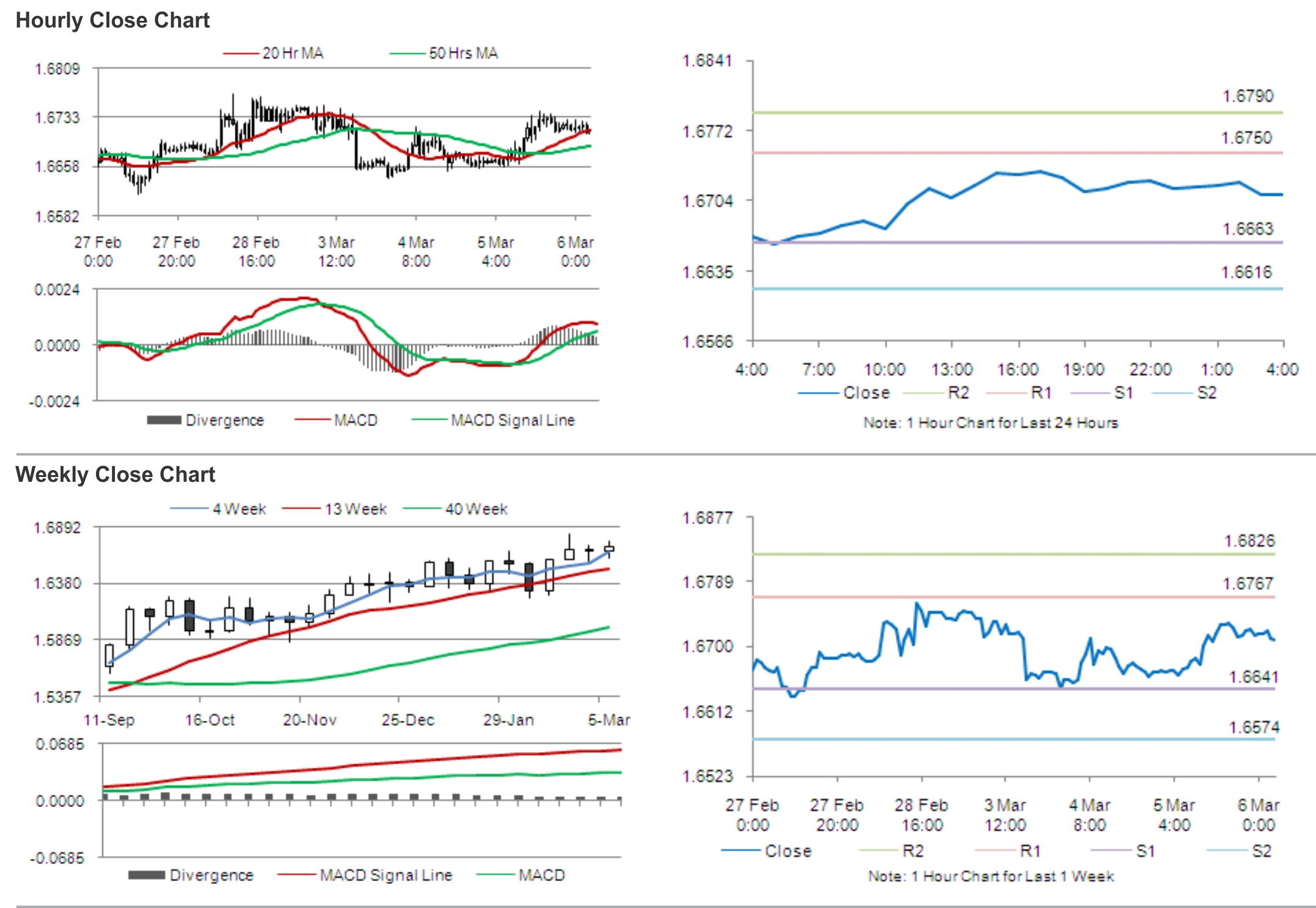

In the Asian session, at GMT0400, the pair is trading at 1.6709, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.6663, and a fall through could take it to the next support level of 1.6616. The pair is expected to find its first resistance at 1.6750, and a rise through could take it to the next resistance level of 1.6790.

Market participants keenly await the Bank of England’s (BoE) decision on its interest rate and asset-purchase facility, which is widely expected to remain unchanged. However, the central bank’s take on the economy would give investors an idea as to how the UK economy is performing.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.