For the 24 hours to 23:00 GMT, the EUR declined 0.53% against the USD and closed at 1.1014, after ZEW survey data indicated that investor sentiment in Germany as well as Euro-zone deteriorated on concerns that the UK’s decision to leave the European Union could weaken the region’s fragile economic recovery. The ZEW economic sentiment index in the Euro-zone fell to a level of -14.7 in July, compared to a level of 20.2 recorded in the prior month. Moreover, the region’s seasonally adjusted construction output fell 0.5% on a monthly basis in May, compared to a revised drop of 0.3% in the prior month. Additionally, Germany’s ZEW survey of economic sentiment index dropped to -6.8 in July, compared to a reading of 19.2 in the previous month while markets expected it to fall to a level of 9.0. Moreover, the nation’s current situation index eased more-than-expected to a level of 49.8 in July, compared to market expectations of a fall to a level of 51.8 and after recording a reading of 54.5 in the prior month.

In the US, macroeconomic data indicated that housing starts rebounded more-than-expected by 4.8% on monthly basis in June, following a revised drop of 1.7% in the prior month and compared to market expectations for a gain of 0.2%. Further, the nation’s building permits rose more-than-anticipated by 1.5% MoM in June, compared to a revised rise of 0.5% in the prior month while markets expected it to advance by 1.2%.

Separately, the International Monetary Fund (IMF), lowered its global growth estimate again for this year and next, with global growth now estimated to grow at 3.1% in 2016 and 3.4% in 2017, as Britain’s historic decision to leave the European Union (EU) last month influenced consumer confidence and investor sentiment.

In the Asian session, at 3:00GMT, the pair is trading at 1.1003, with the EUR trading 0.1% lower against USD from yesterday’s close.

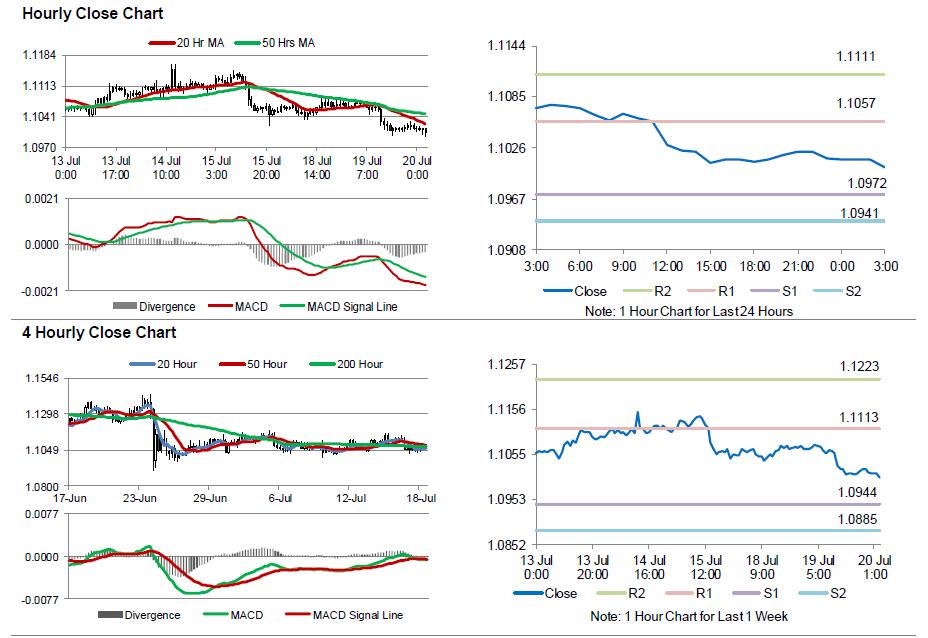

The pair is expected to find support at 1.0972, and a fall through could take it to the next support level of 1.0941. The pair is expected to find resistance at 1.1057, and a rise through could take it to the next resistance level of 1.1111.

Moving ahead, investors will look forward to Euro-zone’s current account and flash consumer confidence data, slated to release today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.