For the 24 hours to 23:00 GMT, the GBP declined 1.23% against the USD and closed at 1.3108.

In economic news, UK’s consumer price index advanced by 0.2% MoM in June, in line with market expectations and compared to a similar rise registered in the prior month. Meanwhile, on an annual basis, the consumer price index rose more-than-forecasted by 0.5% in June, following a surge in airfares and compared to a rise of 0.3% in the prior month.

Meanwhile, the International Monetary Fund (IMF) slashed UK’s growth forecast for next year and warned that the Brexit decision has damaged the economy’s short-term growth prospects. The Fund now expects the economy to grow by 1.3% in 2017.

In the Asian session, at GMT0300, the pair is trading at 1.3073, with the GBP trading 0.27% lower against the USD from yesterday’s close.

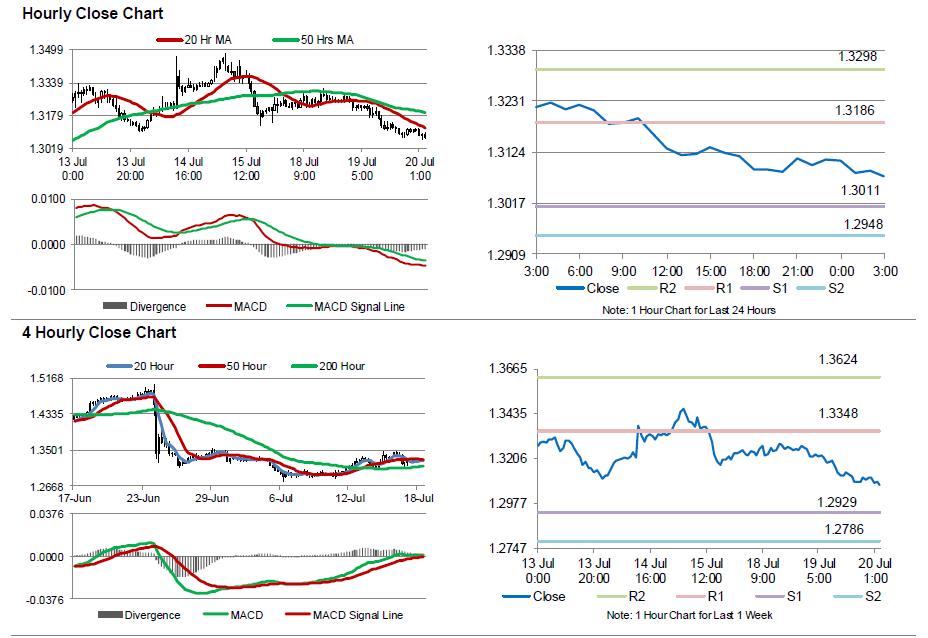

The pair is expected to find support at 1.3011, and a fall through could take it to the next support level of 1.2948. The pair is expected to find its first resistance at 1.3186, and a rise through could take it to the next resistance level of 1.3298.

Going ahead, market participants await the release of UK’s ILO unemployment rate data for the three months ending May, scheduled in a few hours, to gauge the strength in the nation’s economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.