For the 24 hours to 23:00 GMT, EUR declined 1.61% against the USD and closed at 1.4137, amid initial speculation that France’s top-tier AAA credit rating could be downgraded.

However, Standard & Poor’s, Moody’s Investors Service and Fitch Ratings later affirmed France’s top credit grade at ‘AAA’ with a stable outlook.

In Germany, the Consumer Price Index (CPI) rose 2.4% (Y-o-Y) in July, in line with market estimates, compared to a 2.3% rise in June. Also, the Harmonized Index of Consumer Prices (HICP) edged up 2.6% in July, matching market estimates, from a 2.4% growth recorded in June.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4224, 0.62% higher from the levels yesterday at 23:00GMT.

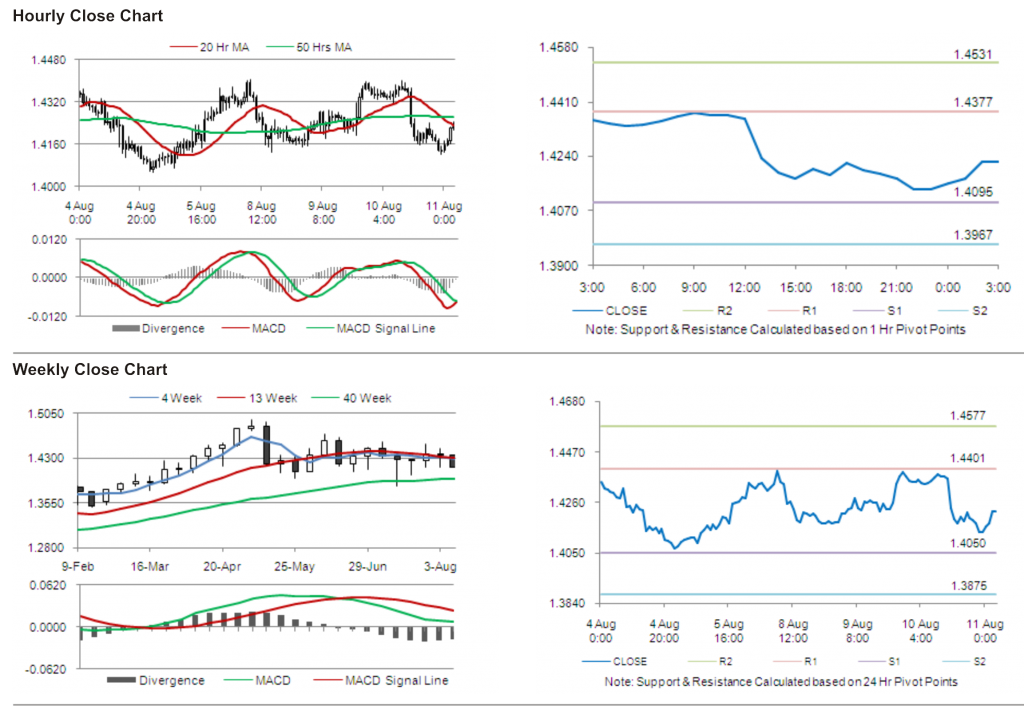

The pair has its first short term resistance at 1.4377, followed by the next resistance at 1.4531. The first support is at 1.4095, with the subsequent support at 1.3967.

Investors are eying ECB monthly report showing the current economic situation, along with other economic releases to be released in the Euro zone later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.