For the 24 hours to 23:00 GMT, USD rose 1.39% against the CAD to close at 0.9938.

The Canadian dollar weakened against the greenback on Wednesday, hurt by concern over a global economic slump, Europe’s debt woes and the prospect of prolonged low interest rates.

In the US, the Treasury Department indicated that the budget deficit climbed to $1.1 trillion to date in the current fiscal year. Also, the budget deficit stood at $129.0 billion in July.

In the Asian session at 3:00GMT, the pair is trading at 0.9892, 0.46% lower from yesterday’s close at 23:00 GMT.

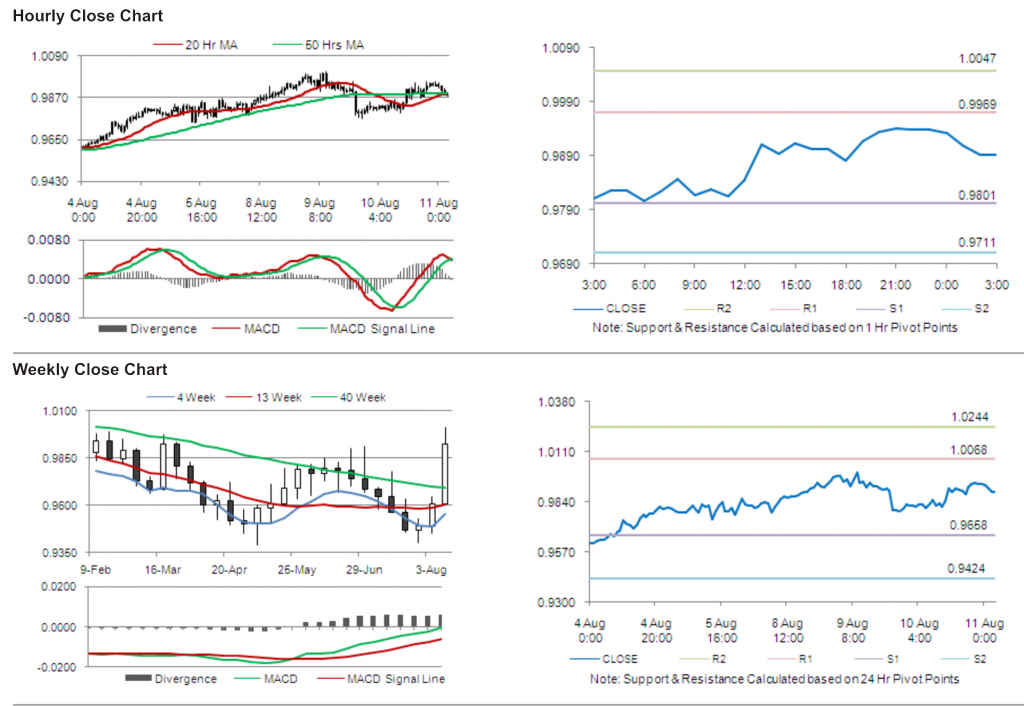

The first area of short term resistance is observed at 0.9969, followed by 1.0047 and 1.0215. The first area of support is at 0.9801, with the subsequent supports at 0.9711 and 0.9543.

The pair is expected to trade on the cues from the release of international merchandise trade data in Canada.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.