For the 24 hours to 23:00 GMT, EUR declined 0.29% against the USD and closed at 1.3129, amid concerns over Greece debt crisis and after disappointing Euro-zone industrial production data.

News that meeting of the Euro-zone officials to discuss Greece’s bailout was postponed, amid incomplete paperwork, also weighed on EUR.

However, losses were limited after German investor sentiment rose sharply in February and posted its first positive reading since May, and as Italian and Spanish borrowing costs dropped at bond auction.

On the economic front, the ZEW Economic Sentiment Index in Germany rose to 5.4 in February, marking the highest level since April 2011, while the Current Situation Index advanced to 40.3 in February. Additionally, the Economic Sentiment Index in Euro-zone climbed to -8.1 in February, from -32.5 in the previous month. Meanwhile, industrial production in the Euro-zone fell 1.1% (MoM) in December.

In the Asian session, at GMT0400, the pair is trading at 1.3166, with the EUR trading 0.28% higher from yesterday’s close, after the People’s Bank of China stated that the nation would participate in resolving Europe’s debt crisis.

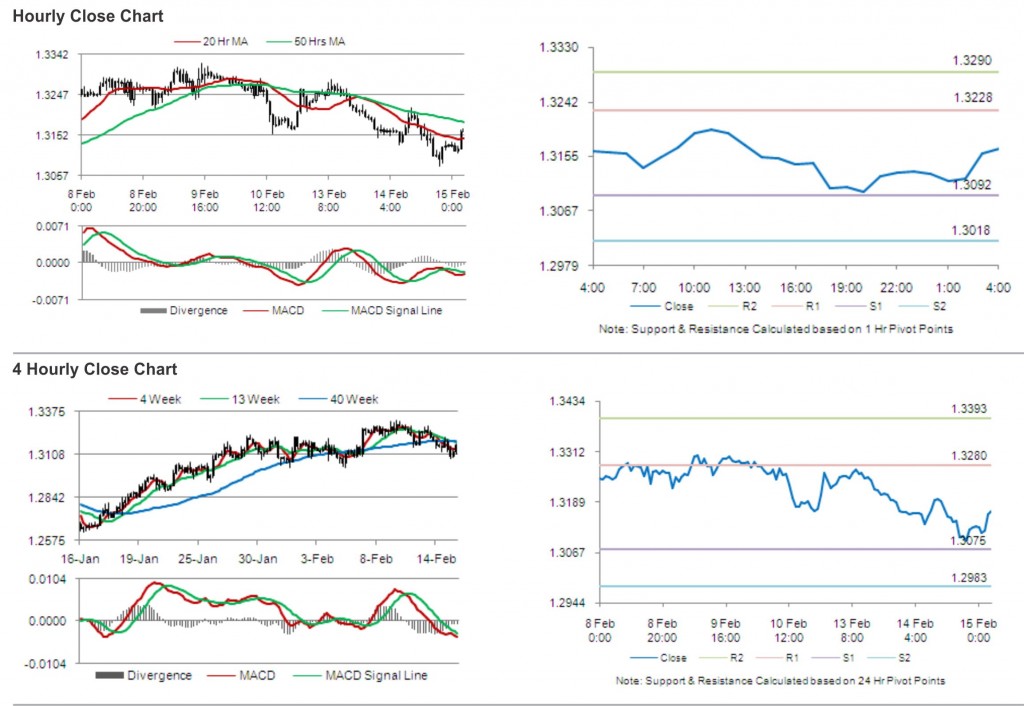

The pair is expected to find support at 1.3092, and a fall through could take it to the next support level of 1.3018. The pair is expected to find its first resistance at 1.3228, and a rise through could take it to the next resistance level of 1.3290.

Trading trends in the pair today are expected to be determined by the release of Euro-zone trade balance and GDP data from France, Germany and Euro-zone.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.