For the 24 hours to 23:00 GMT, GBP fell 0.31% against the USD and closed at 1.5690.

Data released in the UK showed that the Consumer Price Index slowed to 3.6% (YoY) in January, marking the lowest level since November 2010, while the Retail Price Index advanced 3.9% (YoY) in January. Additionally, the Conference Board reported that its Leading Economic Index fell to 102.0 in December, while the Coincident Economic Index rose to 102.4 in December. Separately, the Department for Communities and Local Government (DCLG) reported that the House Price Index rose 0.1% (YoY) in December, for the first time in nine months.

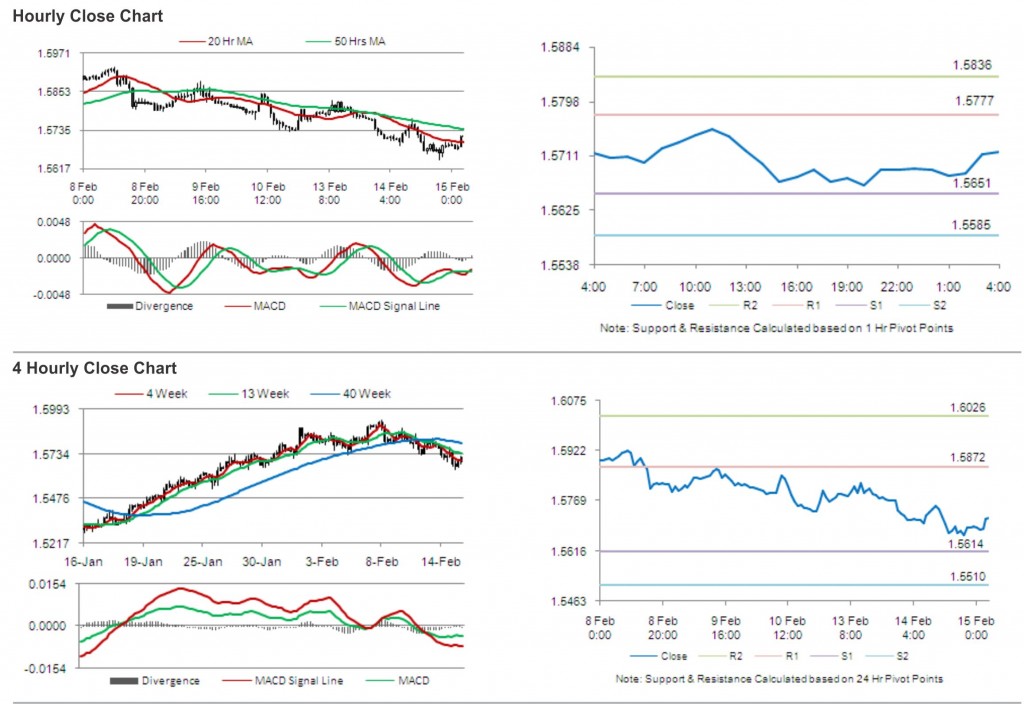

In the Asian session, at GMT0400, the pair is trading at 1.5717, with the GBP trading 0.17% higher from yesterday’s close.

The pair is expected to find support at 1.5651, and a fall through could take it to the next support level of 1.5585. The pair is expected to find its first resistance at 1.5777, and a rise through could take it to the next resistance level of 1.5836.

With a series of UK economic releases today, including ILO Unemployment Rate and Bank of England Quarterly Inflation Report, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.