For the 24 hours to 23:00 GMT, EUR rose 0.52% against the USD, on Friday, and closed at 1.4399, after the report showed that showed the US economy expanded less than expected in the second quarter of 2011.

However, euro came under pressure after Moody’s Investors Service on Friday put Spain’s Aa2 ratings on review for possible downgrade, stating that it faces rising contagion risks as the region’s debt crisis may keep funding costs on the upswing.

On Sunday night, the US President, Barack Obama, indicated that the leaders of the Republican and Democratic parties have agreed on a compromise to raise the US debt ceiling. He also added that the deal would cut about $1.0 trillion in spending over the next 10 years.

In the economic news, the annual inflation in the Euro zone decreased to 2.5% in July, after remaining unchanged at 2.7% for two consecutive months. Meanwhile, in Germany, the retail sales grew 6.3% (M-o-M) in June, following a 2.5% drop in May.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4382, 0.12% lower from the levels on Friday at 23:00GMT.

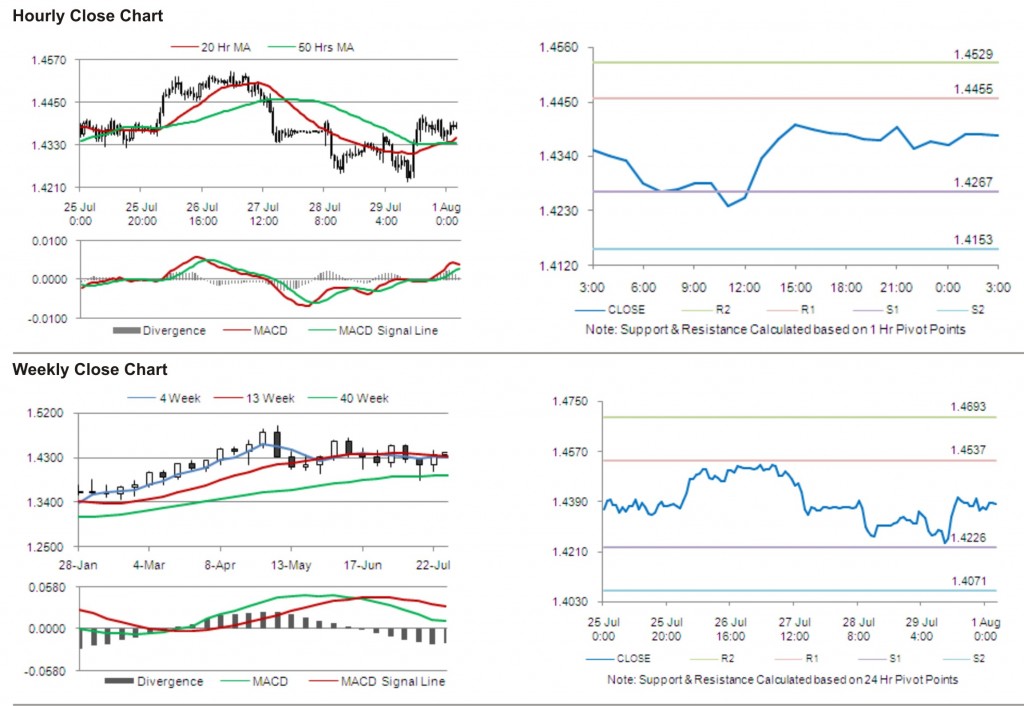

The pair has its first short term resistance at 1.4455, followed by the next resistance at 1.4529. The first support is at 1.4267, with the subsequent support at 1.4153.

Trading trends in the pair today are expected to be determined by release of manufacturing purchasing manager index and unemployment rate in the Euro zone.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.