For the 24 hours to 23:00 GMT, EUR declined 0.23% against the USD and closed at 1.4184, amid worries that Ireland is having trouble paying off its debt, bringing sovereign-debt worries in the region again to the forefront.

In the US, Dallas Fed President Richard Fisher stated that, there would be no need for further monetary accommodation in the US once the Federal Reserve’s current round of quantitative easing runs out in June. In economic news in the US, seasonally adjusted composite manufacturing activity index declined to 20.0 in March, following a reading of 25.0 in February.

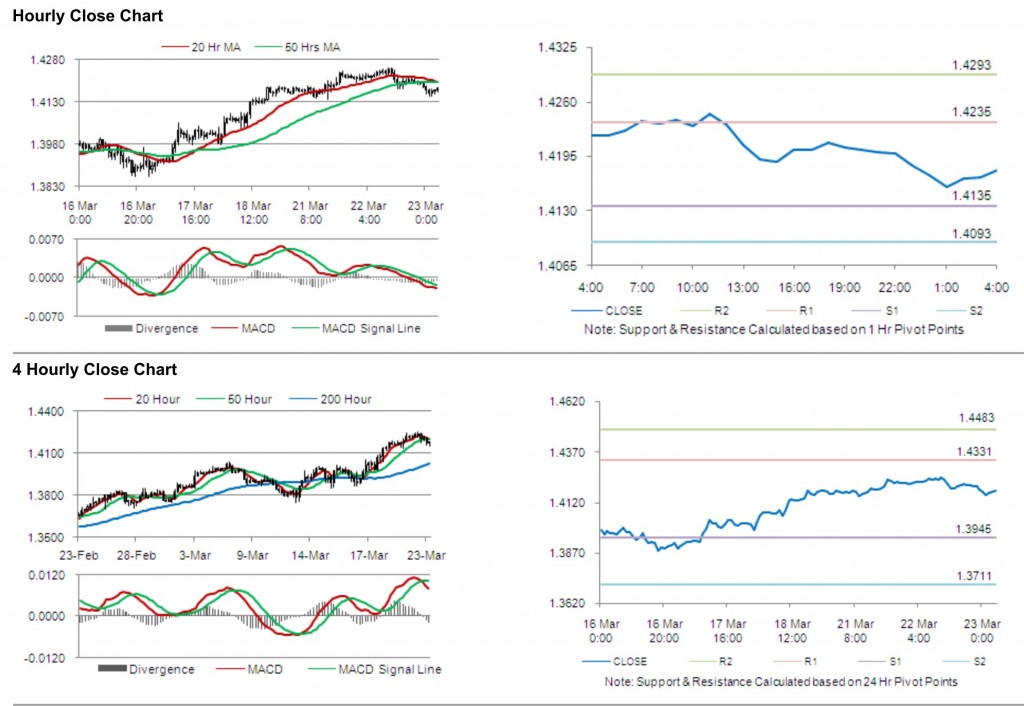

In the Asian session, at 4:00GMT, the EURUSD is trading at 1.4178, 0.04% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4235, followed by the next resistance at 1.4293. The first support is at 1.4135, with the subsequent support at 1.4093.

Trading trends in the pair today are expected to be determined by data release on industrial new orders and consumer confidence in the EU.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.