For the 24 hours to 23:00 GMT, GBP rose 0.35% against the USD and closed at 1.6365.

The Bank of England’s Monetary Policy Committee member Andrew Sentence, stated that, there is a risk that the committee may be forced into “destabilising” rate hikes to tackle inflation, which could easily move above 5%.

In the UK, on an annual basis, the consumer price index (CPI) rose by 4.4% (Y-o-Y) in February, following a 4.0% increase in January. Meanwhile, CBI industrial trends survey’s total order book balance rose to a reading of 5.0 in March compared to reading of -8.0 in February. Additionally, retail price index rose by 5.5% (Y-o-Y) in February compared to 5.1% increase in January. Meanwhile, public sector net borrowing rose to £11.8 billion in February from a borrowing of £9.5 billion posted in the same period last year.

The pair opened the Asian session at 1.6365, and is trading at 1.6369 at 4.00GMT. The pair is trading 0.02% higher from the New York session close.

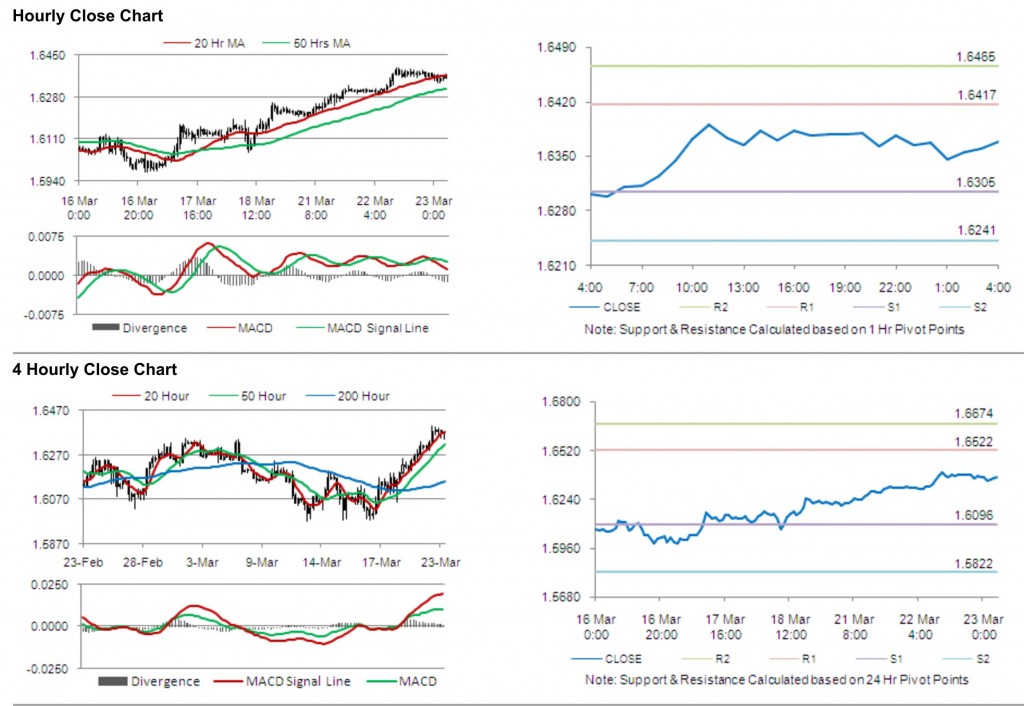

The pair has its first short term resistance at 1.6417, followed by the next resistance at 1.6465. The first support is at 1.6305, with the subsequent support at 1.6241.

Investors are eying annual budget release along with other economic releases in the UK to be released later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.