For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.2473. However, gains in the Euro were kept in check following disappointing manufacturing PMI data in the Euro-zone as well as in Germany.

Germany’s manufacturing PMI unexpectedly fell to a 17-month low of 49.5 in November, lower than market expectations for a reading of 50.0 and compared to a similar figure registered in October, thus highlighting contraction in manufacturing activities of the Euro-zone’s biggest economy. Additionally, the Euro-zone’s manufacturing PMI recorded a drop to 50.1 in November, compared to a level of 50.6 in the prior month, while market expectations were for the index to fall to 50.4.

Elsewhere, in France, the Euro-zone’s second biggest economy, manufacturing PMI activity remained in the contraction territory in November, while the condition in Italy further deteriorated in the same month. Meanwhile, Italy’s GDP declined 0.5% on an annual basis in 3Q 2104, higher than market expectations for it to ease 0.4% and compared to a similar drop registered in the prior quarter, thus showing that the nation remained in recession.

In the US, the ISM manufacturing activity index dropped to 58.7 in November, less than market expectations of a fall to a level of 58.0. The index had recorded a reading of 59.0 in the prior month. Meanwhile, Markit’s manufacturing PMI for US surprisingly dropped to a 10-month low of 54.8 in November, lower than market expectations of a drop to a level of 55.0 and following a reading of 54.7 registered in October.

Separately, the New York Fed President, William Dudley, opined that he expects the central bank to hike interest rates in the middle of 2015. He also termed the declining oil prices as “beneficial” for the US economy.

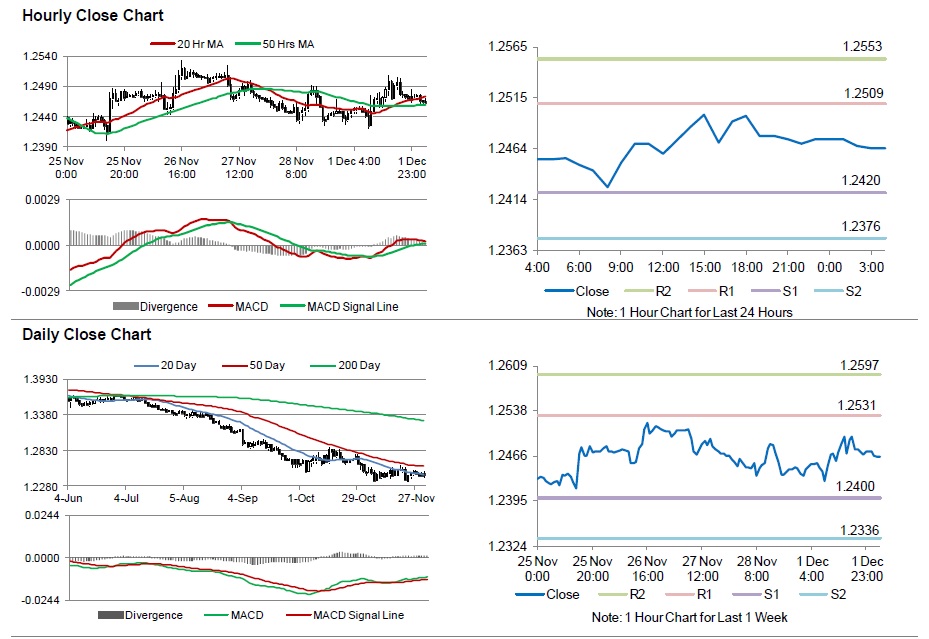

In the Asian session, at GMT0400, the pair is trading at 1.2465, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.2420, and a fall through could take it to the next support level of 1.2376. The pair is expected to find its first resistance at 1.2509, and a rise through could take it to the next resistance level of 1.2553.

Trading trends in the pair today are expected to be determined by global macroeconomic news.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.