For the 24 hours to 23:00 GMT, the GBP rose 0.63% against the USD and closed at 1.5731, following an upbeat manufacturing PMI data in the UK.

The manufacturing PMI in the UK surprisingly climbed to 53.5 in November, posting its highest level in 4-months, exceeding market expectations of a drop to a level of 53.0 and compared to a revised reading of 53.3 recorded in October, thus showing continued growth in Britain’s factory output.

In other economic news, the nation’s mortgage approvals eased to 59.4 K, marking its lowest level since June 2013 in October and compared to a revised level of 61.2 K registered in the preceding month. Meanwhile, net consumer credit advanced to £1.1 billion in October, more than market expectations for an advance of £1.0 billion and following previous month’s rise of £0.9 billion.

In the Asian session, at GMT0400, the pair is trading at 1.5730, with the GBP trading flat from yesterday’s close.

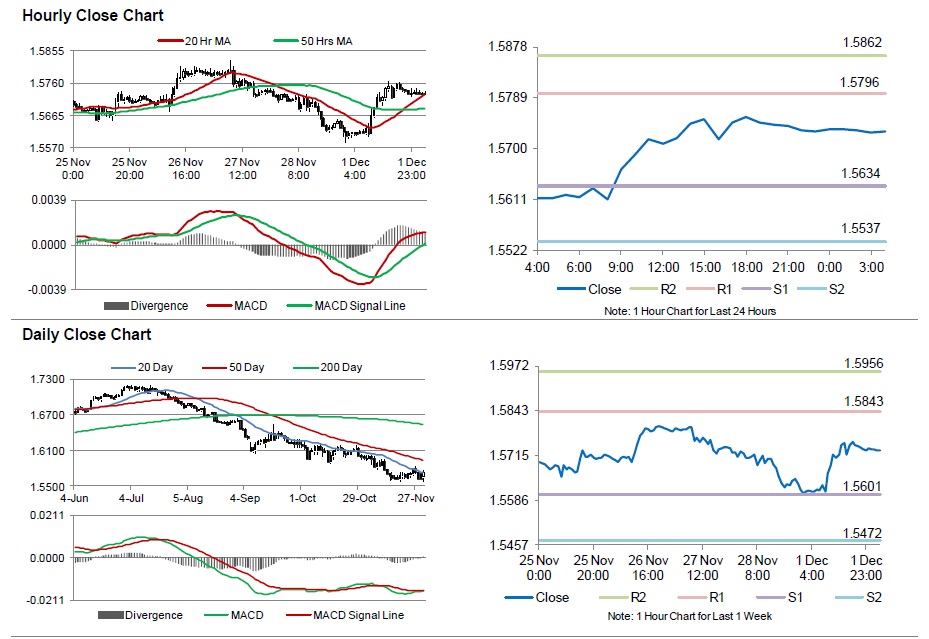

The pair is expected to find support at 1.5634, and a fall through could take it to the next support level of 1.5537. The pair is expected to find its first resistance at 1.5796, and a rise through could take it to the next resistance level of 1.5862.

Trading trends in the Pound today are expected to be determined by the UK’s construction PMI data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.