For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.2757, after the ECB Chief, Mario Draghi, reiterated that the central bank could use additional unconventional measures if the region witnesses prolonged period of low inflation. He, further mentioned that the geopolitical tensions could hamper economic recovery of the region but expects moderate growth in the current fiscal.

In other news, the seasonally adjusted M3 money supply in the Euro-zone advanced 2.0%, on an annual basis, in August, higher than market expectations for an advance of 1.9% and compared to a rise of 1.8% registered in the prior month. Meanwhile, on an annual basis, the producer price index eased 0.6% in Spain, in August. Elsewhere, in Italy, the seasonally adjusted retail sales dropped 0.1%, on a monthly basis, in July.

In the US, durable goods order tumbled 18.2% in August, after advancing 22.5% in the previous month, while markets were expecting it to register a drop of 18%. Meanwhile, number of people filing new claims for unemployment benefits rose less than expected to 293K in the week ended 20 September, compared to market expectations of 296K and following prior week’s level of 281K. Additionally, continuing jobless claims in the nation advanced to 2,439K in the week ended 13 September, lower than market expectations of a rise to 2,440K. However, the US services PMI registered a level of 58.5 in September, slightly down from previous month’s level of 59.5. Market expectations were for it to come in at 59.2. On the other hand, the Kansas Fed manufacturing activity advanced to 6.0 in September, in line with market expectations.

The Atlanta Fed President, Dennis Lockhart, expressed his optimism for the US economy but still wants to see more data to prove that growth is on a sustainable path before raising interest rates. He, further, urged policymakers to hold off raising short-term interest rates until mid-2015 or later.

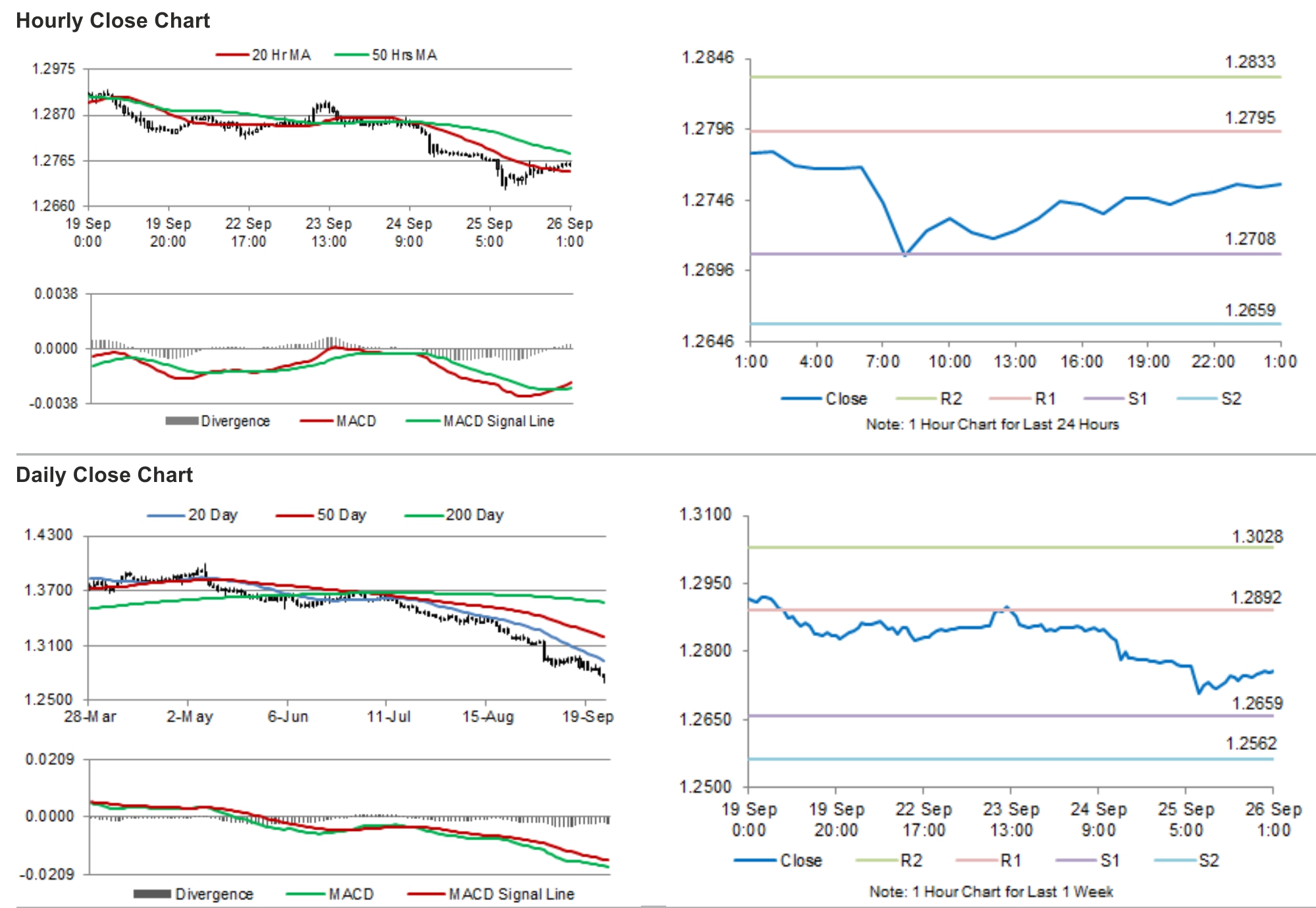

In the Asian session, at GMT0300, the pair is trading at 1.2746, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.2702, and a fall through could take it to the next support level of 1.2657. The pair is expected to find its first resistance at 1.2786, and a rise through could take it to the next resistance level of 1.2825.

Trading trends in the Euro today would be determined by Germany’s consumer confidence data, scheduled in a few hours. Later in the day, GDP data from the US would also keep the investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.