For the 24 hours to 23:00 GMT, the GBP traded tad lower against the USD and closed at 1.6325.

Yesterday, the BoE Governor, Mark Carney, stated that the central bank is inching closer towards an interest rate hike, as Britain’s economic outlook has improved significantly. He, further, indicated that rate increases would be limited and gradual.

Separately, the BoE’s Deputy Governor, Nemat Shafik, cautioned that the Euro-zone’s weak economic health poses a “significant risk” to the UK economy. She, further, indicated that the central bank would hike its interest rates if wage growth in the nation picks up.

In economic news, the UK house prices remained steady, on a monthly basis, in September, after advancing 0.1% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.6311, with the GBP trading 0.09% lower from yesterday’s close.

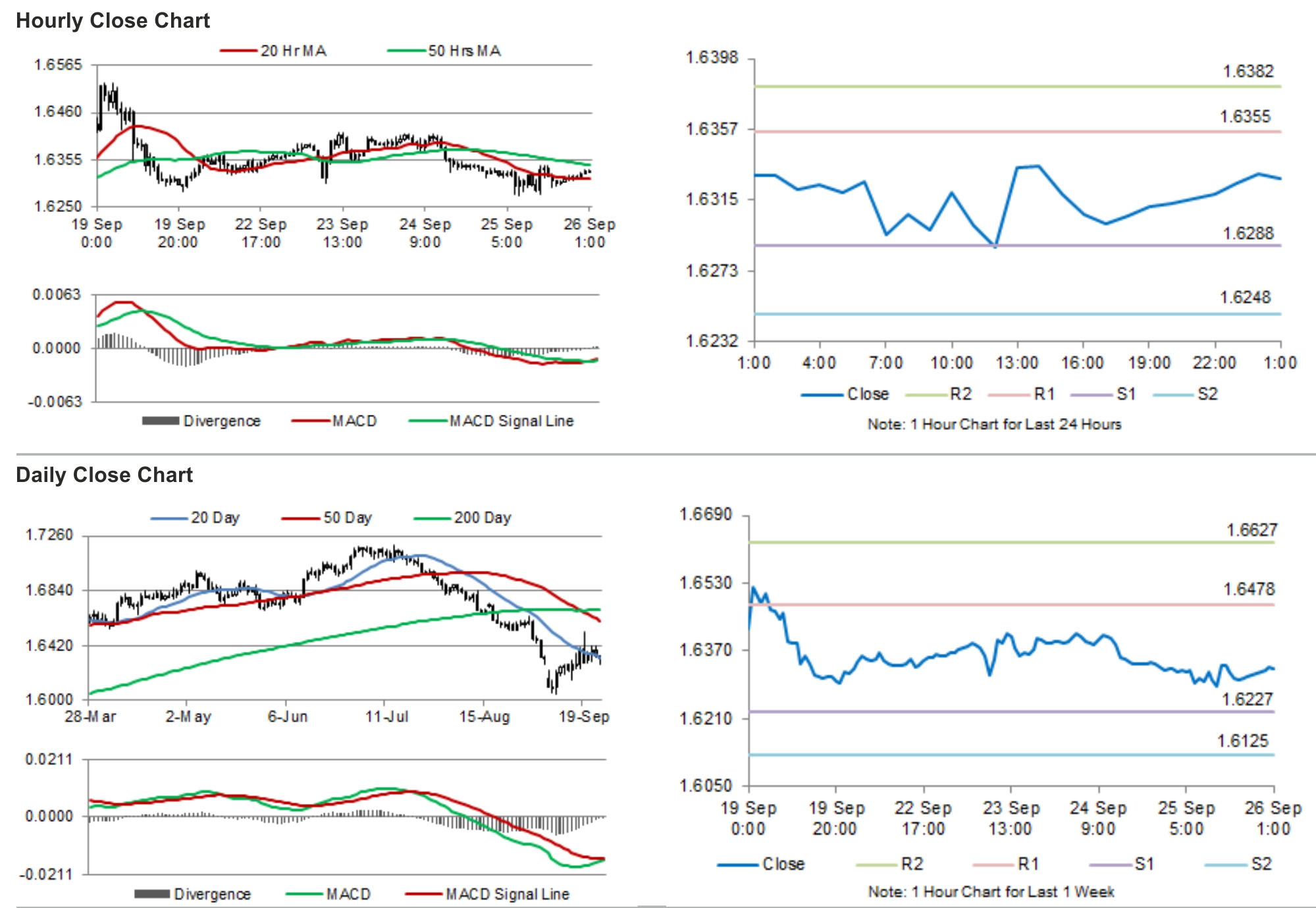

The pair is expected to find support at 1.6277, and a fall through could take it to the next support level of 1.6242. The pair is expected to find its first resistance at 1.6344, and a rise through could take it to the next resistance level of 1.6376.

Amid no economic releases from the UK today, investor sentiments would be governed by news from other countries.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.