For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1156.

In the US, data showed that the MBA mortgage applications rose 2.4% on a weekly basis in the week ended 17 May 2019, following a drop of 0.6% in the previous week.

The FOMC May meeting minutes showed that policymakers are in no rush for a near-term move in monetary policy as inflation is likely to remain subdued. Additionally, the minutes indicated that the Fed’s patient approach to rate-change would be appropriate “for some time.”

In the Asian session, at GMT0300, the pair is trading at 1.1152, with the EUR trading marginally lower against the USD from yesterday’s close.

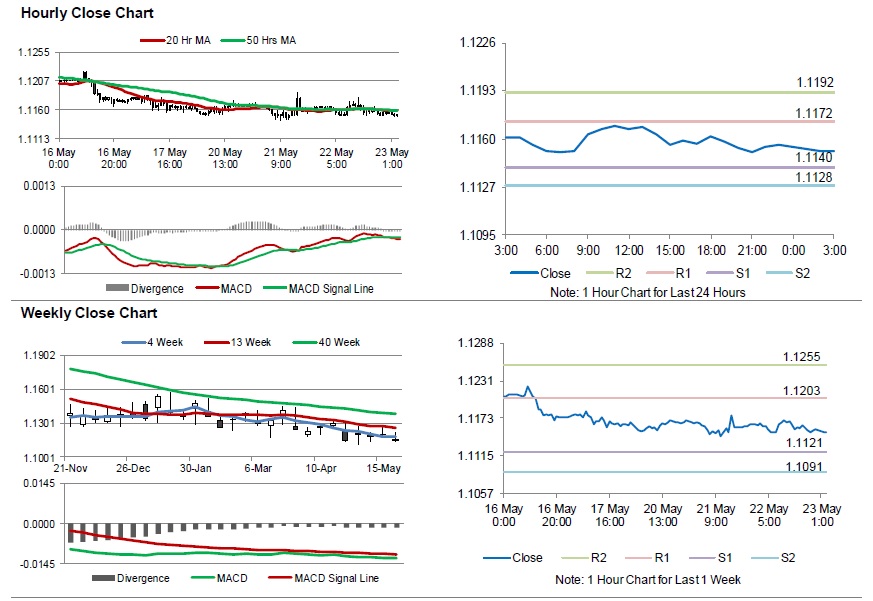

The pair is expected to find support at 1.1140, and a fall through could take it to the next support level of 1.1128. The pair is expected to find its first resistance at 1.1172, and a rise through could take it to the next resistance level of 1.1192.

Moving ahead, traders would await the European Central Bank’s April meeting minutes and

Germany’s IFO survey indices for May, scheduled to release in a few hours. Also, the Markit manufacturing and services PMI for May, set to release across the euro bloc, will garner significant amount of investors attention. Later in the day, the US Markit manufacturing and services PMI’s for May, new home sales for April followed by the initial jobless claims, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.