For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.2664, amid speculation that Prime Minister Theresa May’s leadership could come to an end, after her new Brexit plan was rejected.

On the data front, UK’s consumer price index (CPI) advanced 2.1% on a yearly basis in April, less than market forecast for a rise of 2.2% and compared to a gain of 1.9% in the prior month. Additionally, Britain’s public sector net borrowing posted a deficit of £5.0 billion in April, following a revised surplus of £1.0 billion in the previous month. Markets had anticipated public sector net borrowing to record a deficit of £5.1 billion. Meanwhile, the nation’s retail price index rose 3.0% on an annual basis in April, surpassing market expectations for an increase of 2.8%. The index had registered a rise of 2.4% in the prior month. Also, the house price index climbed 1.4% on an annual basis in April, compared to a revised gain of 1.0% in the prior month.

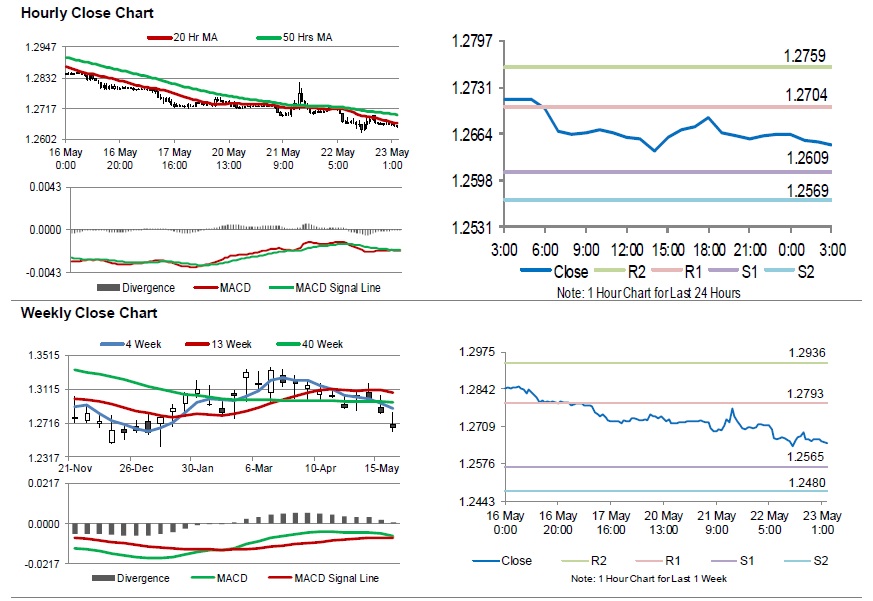

In the Asian session, at GMT0300, the pair is trading at 1.2649, with the GBP trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2609, and a fall through could take it to the next support level of 1.2569. The pair is expected to find its first resistance at 1.2704, and a rise through could take it to the next resistance level of 1.2759.

Amid lack of macroeconomic releases in UK today, traders would focus on the global macroeconomic releases for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.