For the 24 hours to 23:00 GMT, the EUR declined 2.52% against the USD and closed at 1.1086,

In economic news, Germany’s Ifo business climate index advanced more-than-expected to a level of 108.7 in June, its highest level since November 2015, following a reading of 107.7 in the previous month. Additionally, the nation’s current assessment index registered an unexpected rise to a level of 114.5 in June, compared to a level of 114.2 in the prior month. Market anticipation was for the index to fall to a level of 114.0. Further, the business expectations index surprisingly climbed to a level of 103.1 in June, after registering a reading of 101.6 in the previous month.

On the economic data front, flash durable goods orders slid more-than-expected by 2.2% MoM in May, following a 3.4% rise in the previous month. Moreover, the nation’s final Reuters/Michigan consumer sentiment index fell to a level of 93.5 in June, lower than market expectations of a fall to 94.0. The preliminary figures had recorded a fall to 94.30. In the previous month, the index had registered a reading of 94.7.

In the Asian session, at GMT0300, the pair is trading at 1.0999, with the EUR trading 0.78% lower against the USD from Friday’s close.

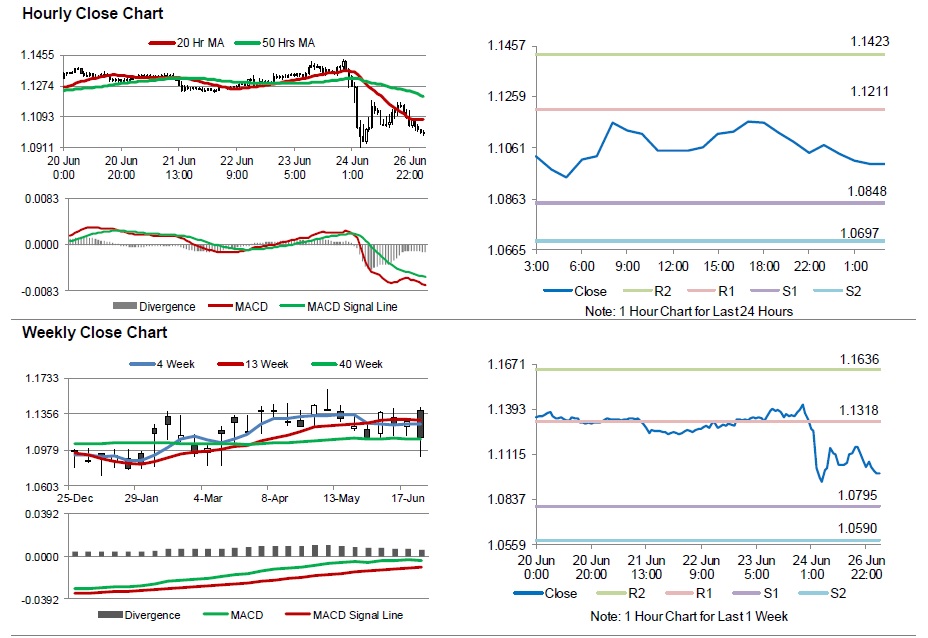

The pair is expected to find support at 1.0848, and a fall through could take it to the next support level of 1.0697. The pair is expected to find its first resistance at 1.1211, and a rise through could take it to the next resistance level of 1.1423.

Moving ahead, investors will look forward to the US Markit services PMI and advance goods trade balance data, scheduled to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.