For the 24 hours to 23:00 GMT, the GBP fell 8.38% against the USD and closed at 1.3633, plunging to a 31-year low, after Britain voted to leave the European Union (EU). Those in favour of leaving the European Union garnered 51.9% of the vote, while 48.1% chose to remain. The UK Prime Minister, David Cameron, who had strongly rooted for a “Remain” vote, announced that he will step down in October this year.

Additionally, the Bank of England (BoE) Governor, Mark Carney, tried to calm and soothe financial markets by reassuring investors that the central bank is “well prepared” to prop up Britain’s financial system in order to protect it from the direct impacts of Brexit. He stated that the BoE is ready to provide £250 billion of additional funds to support financial markets and that the central bank will consider whether to take additional policy responses in the coming weeks.

In other economic news, UK’s BBA mortgage approvals recorded an unexpected rise to 42.2K in May, compared to market expectations of a fall to a level of 37.9K. In the previous month, BBA mortgage approvals had recorded a revised reading of 40.0K.

In the Asian session, at GMT0300, the pair is trading at 1.3396, with the GBP trading 1.74% lower against the USD from Friday’s close.

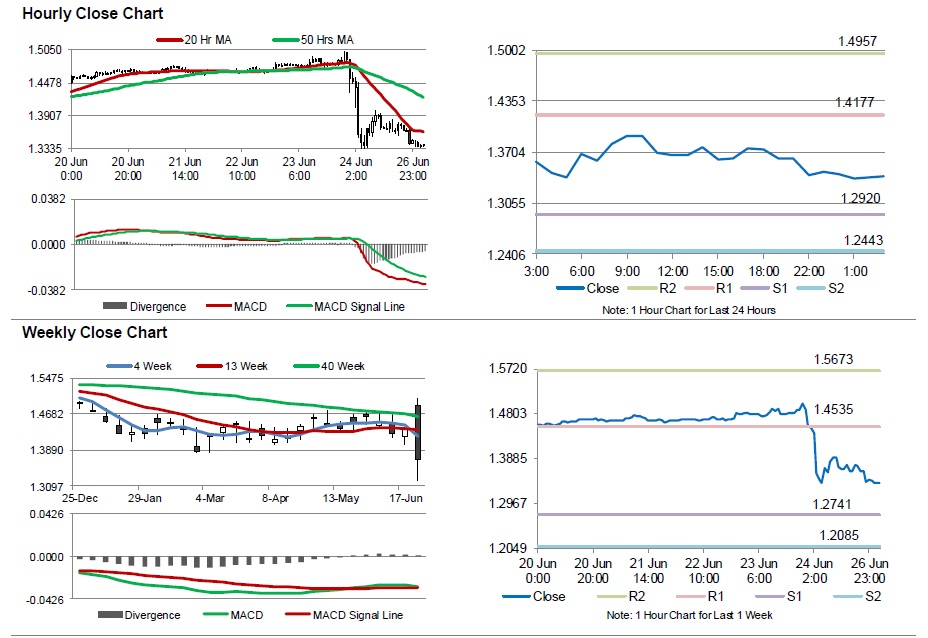

The pair is expected to find support at 1.2920, and a fall through could take it to the next support level of 1.2443. The pair is expected to find its first resistance at 1.4177, and a rise through could take it to the next resistance level of 1.4957.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.