For the 24 hours to 23:00 GMT, the EUR traded tad lower against the USD and closed at 1.3131, after the German GDP, Euro-zone’s biggest economy, contracted in the second quarter of 2014, the first time since the fourth quarter of 2012. The seasonally adjusted final GDP in Germany recorded a drop of 0.2% on a quarterly basis, in 2Q 2014, meeting market expectations. It had risen by a revised 0.7% in the prior quarter. Moreover, the PMI for the German manufacturing sector unexpectedly declined to 51.4 in August, its slowest rate since September 2013, while analysts had expected a reading of 52.0, following a similar reading in July.

In other economic news, the rate of expansion in Euro-zone manufacturing production eased to a 13-month low in August. The PMI in the Euro-zone dropped to 50.7 in August, compared with 51.8 in July, marking it the fourth consecutive month of slowing PMI in the single currency-bloc. Elsewhere, the French PMI came in at 46.9 in August, above market expectations for a reading of 46.5, while the Italian manufacturing activity shrank in August for the first time in more than a year, adding to signs that the Euro-zone’s third-largest economy is stagnating. Spanish manufacturing PMI came in at 52.8 in August, below market expectations of a reading of 53.1.

Moreover, with prospects of more sanctions by EU leaders on Russia for its recent incursion in Ukraine, the Euro is expected to remain under pressure.

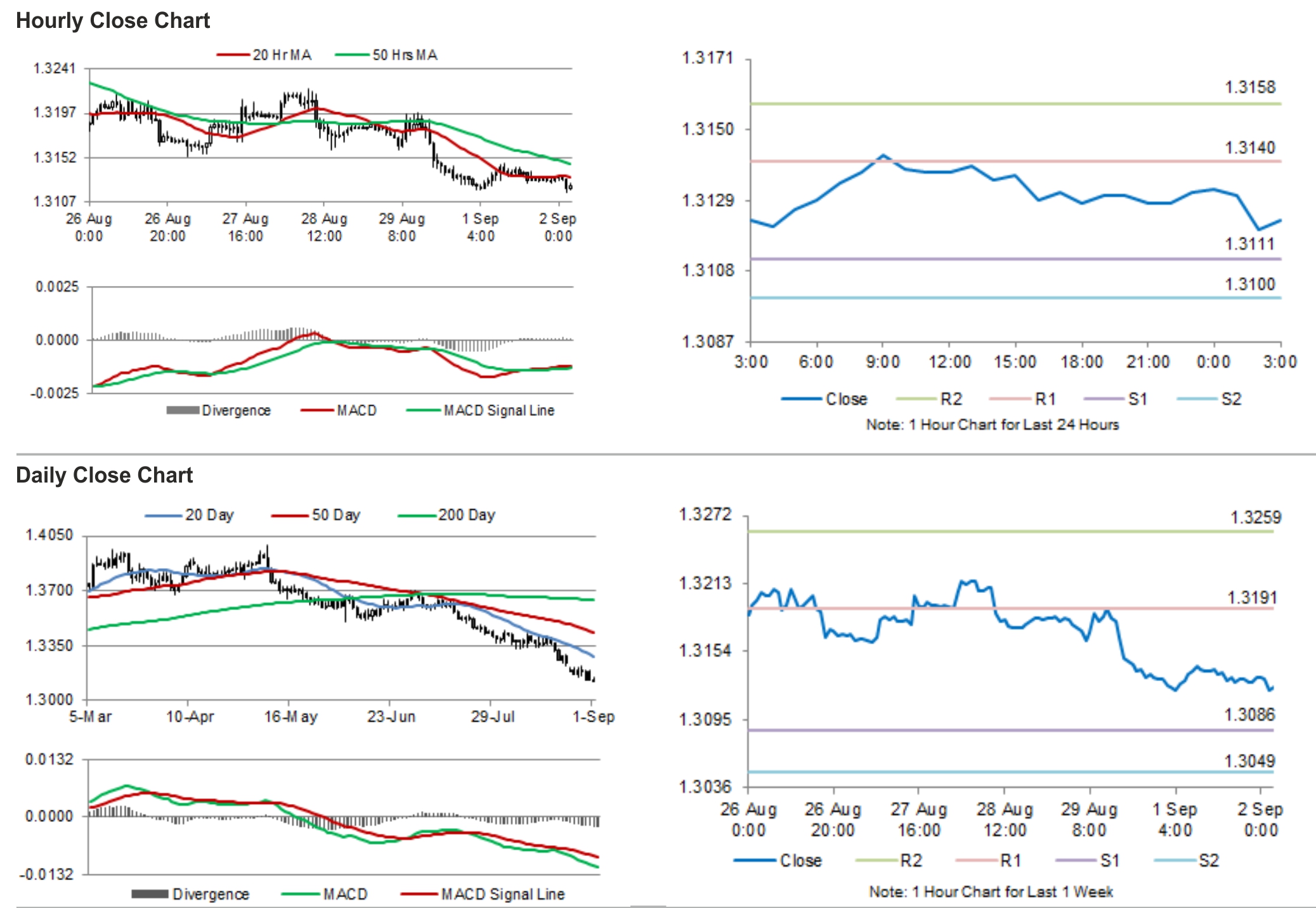

In the Asian session, at GMT0300, the pair is trading at 1.3123, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.3111, and a fall through could take it to the next support level of 1.3100. The pair is expected to find its first resistance at 1.314, and a rise through could take it to the next resistance level of 1.3158.

Going forward, investors would pay attention to a slew of economic releases from the US later in the day.

The currency pair is trading below with its 20 Hr and 50 Hr moving averages.