For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.6612.

In economic news, the UK market PMI edged down in August to 52.5, falling to its lowest level in 14-months, against market expectations for a reading of 55.1 and compared to a reading of 54.8 registered in the prior month. Meanwhile, the mortgage approvals in the UK fell in July to 66.6K, more than market expectations of a drop to 66.0K and compared to a level of 67.1K, registered in June. Additionally, data revealed that the UK borrowings rose a total of £3.4 billion in July, net of repayments, the highest in six years. The amount borrowed by consumers through on credit cards and unsecured loans surged to £1.1 billion in July, compared to £655 million in the previous month.

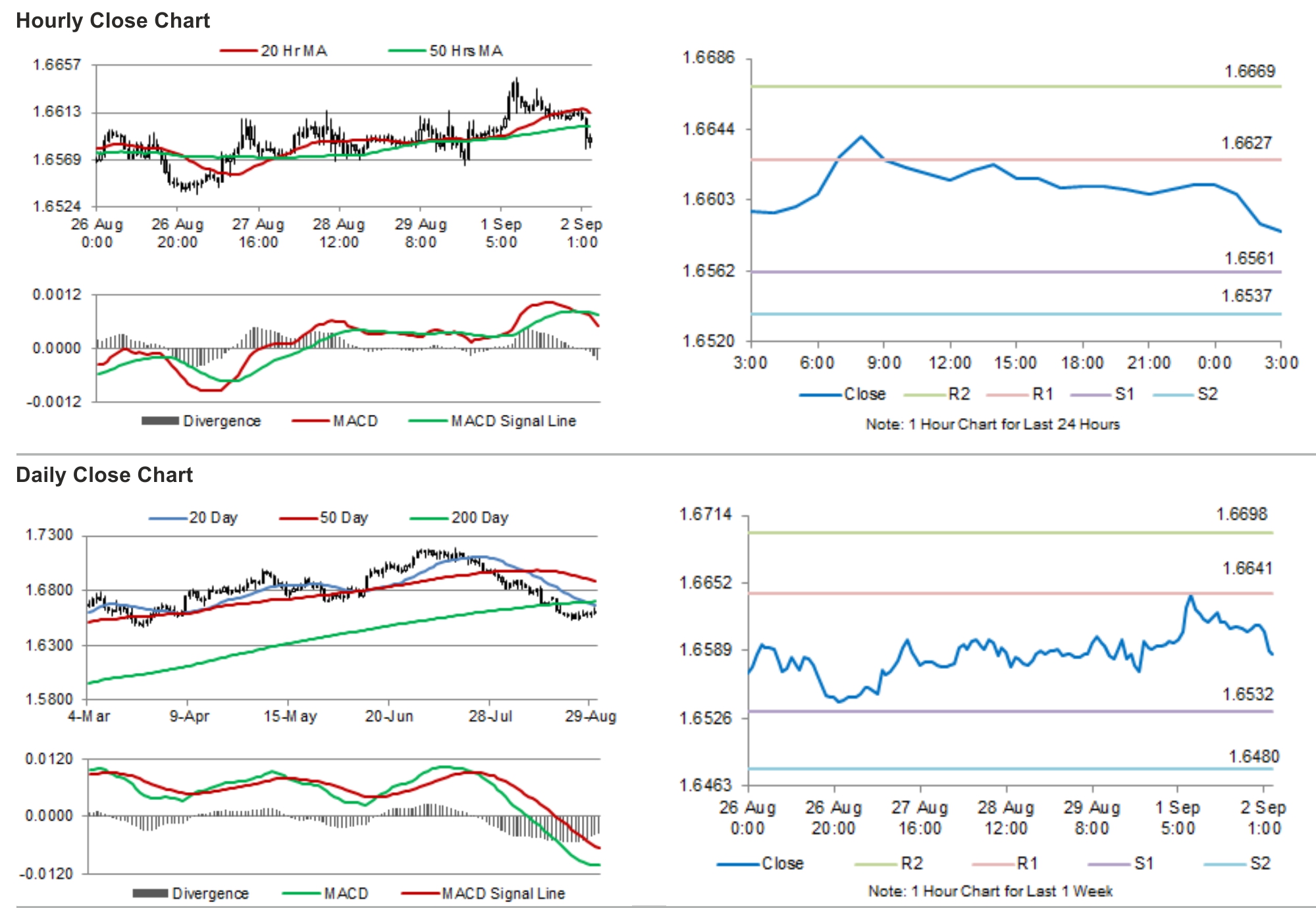

In the Asian session, at GMT0300, the pair is trading at 1.6585, with the GBP trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.6561, and a fall through could take it to the next support level of 1.6537. The pair is expected to find its first resistance at 1.6627, and a rise through could take it to the next resistance level of 1.6669.

Trading trends in the Pound today are expected to be determined by the PMI construction data from the UK, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.