For the 24 hours to 23:00 GMT, EUR declined 0.69% against the USD and closed at 1.4026, after Standard & Poor’s cut its outlook on Italy and the Spanish elections raised concerns that European governments were sinking under too much debt.

In the Euro zone, the services purchasing manufacturing index declined to 55.4 in May from 56.7 in April. Additionally, the manufacturing purchasing manufacturing index declined to 54.8 in May from 58.0 in April.

Italy was dragged into the credit spotlight after Standard & Poor’s late Friday downgraded its outlook on Italy’s A-plus sovereign-debt rating to ‘Negative’ from ‘Stable’. Separately, regional elections in Spain weren’t favorable for the ruling Socialist party and were viewed as a backlash against further austerity measures.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4053, 0.19% higher from the levels yesterday at 23:00GMT.

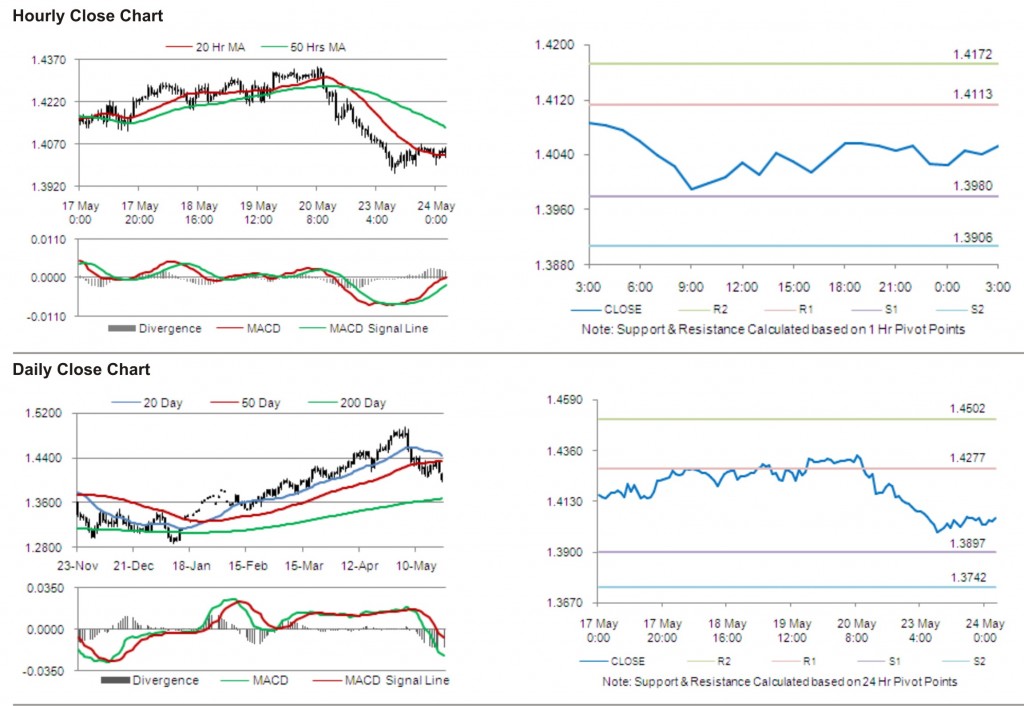

The pair has its first short term resistance at 1.4113, followed by the next resistance at 1.4172. The first support is at 1.3980, with the subsequent support at 1.3906.

Trading trends in the pair today are expected to be determined by data release on industrial new orders in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.