For the 24 hours to 23:00 GMT, GBP fell 0.78% against the USD and closed at 1.6092. The pound traded lower against the US dollar on Monday, as concerns over possible debt restructuring in Greece and ratings outlook downgrade in Italy saw investors slash exposure to riskier assets.

The Bank of England Chief Economist, Spencer Dale, stated that interest rate should increase gradually over the next two years to tackle inflation.

The pair opened the Asian session at 1.6092, and is trading at 1.6106 at 3.00GMT. The pair is trading 0.09% higher from the New York session close.

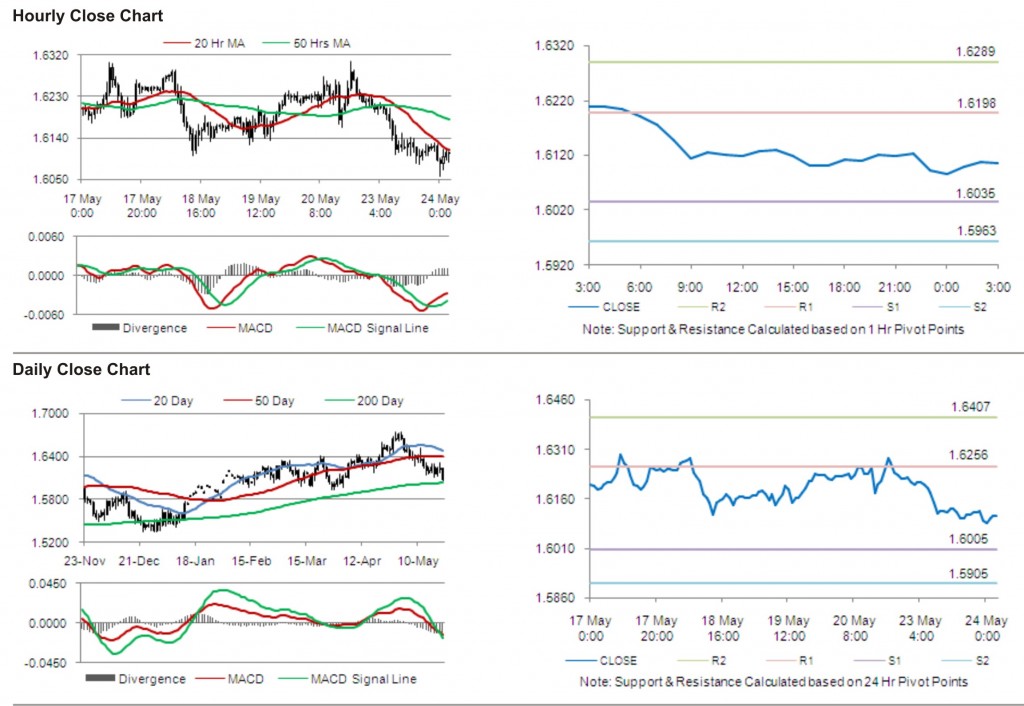

The pair has its first short term resistance at 1.6198, followed by the next resistance at 1.6289. The first support is at 1.6035, with the subsequent support at 1.5963.

Trading trends in the pair today are expected to be determined by release of data on public sector net borrowing in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.