For the 24 hours to 23:00 GMT, EUR declined 0.07% against the USD and closed at 1.3735, as Moody Investors Service, late on Monday, warned that France’s Aaa credit rating could be at risk. Also, yesterday, Moody’s downgraded Spain’s credit rating to A1 from Aa2 with the outlook remaining negative.

However, EUR pared some of its losses after Guardian newspaper stated that France and Germany have agreed a €2-trillion rescue find as a part of plan to resolve the debt crisis.

In economic news, the Economic Sentiment Index in Europe declined to -51.2 in October, compared to a reading of -44.6 in September. Additionally, in Germany, the ZEW’s Economic Sentiment Index declined to -48.3 in October, from -43.3 in September. The Current Situation index declined to 38.4 in October, from 43.6 in September.

In the Asian session, at GMT0300, the pair is trading at 1.3781, with the EUR trading 0.33% higher from yesterday’s close.

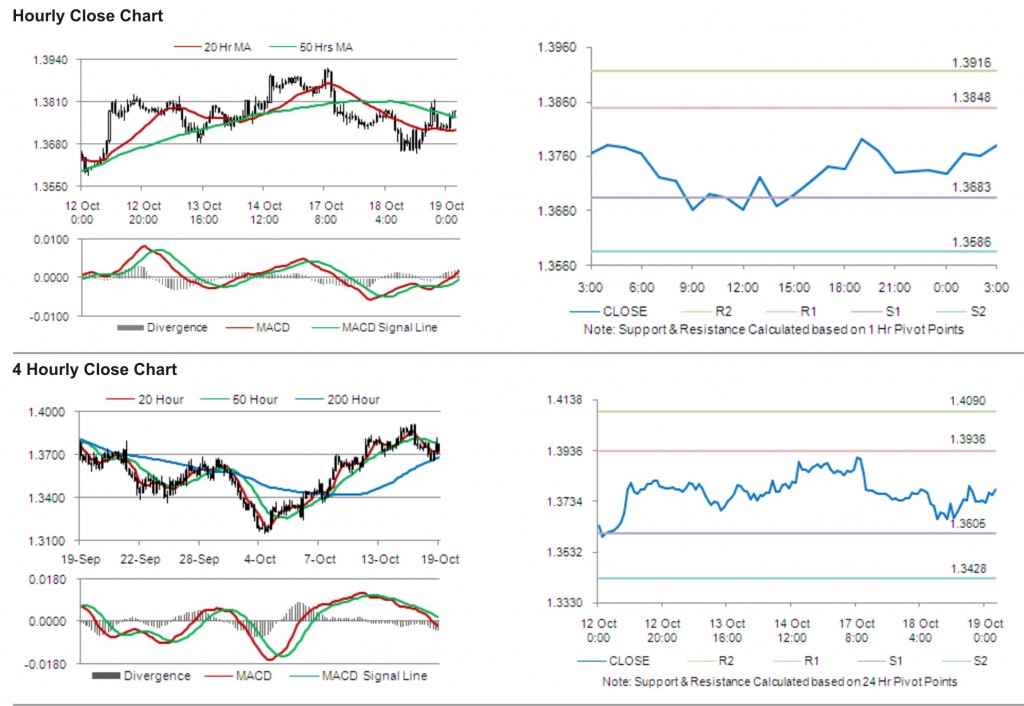

The pair is expected to find support at 1.3683, and a fall through could take it to the next support level of 1.3586. The pair is expected to find its first resistance at 1.3848, and a rise through could take it to the next resistance level of 1.3916.

Trading trends in the pair today are expected to be determined by data release on current account and construction output in the Eurozone.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.