For the 24 hours to 23:00 GMT, GBP fell 0.20% against the USD and closed at 1.5713, as higher UK inflation failed to persuade investors that the Bank of England (BoE) would temper its bond-buying program after it was revived this month.

In the UK, the Consumer Price Index (CPI) rose 0.6% (M-o-M) in September, following a similar rise in the previous month. Additionally, on an annual basis, retail price index rose 5.6% in September, compared to a rate of 5.2% rise in the previous month.

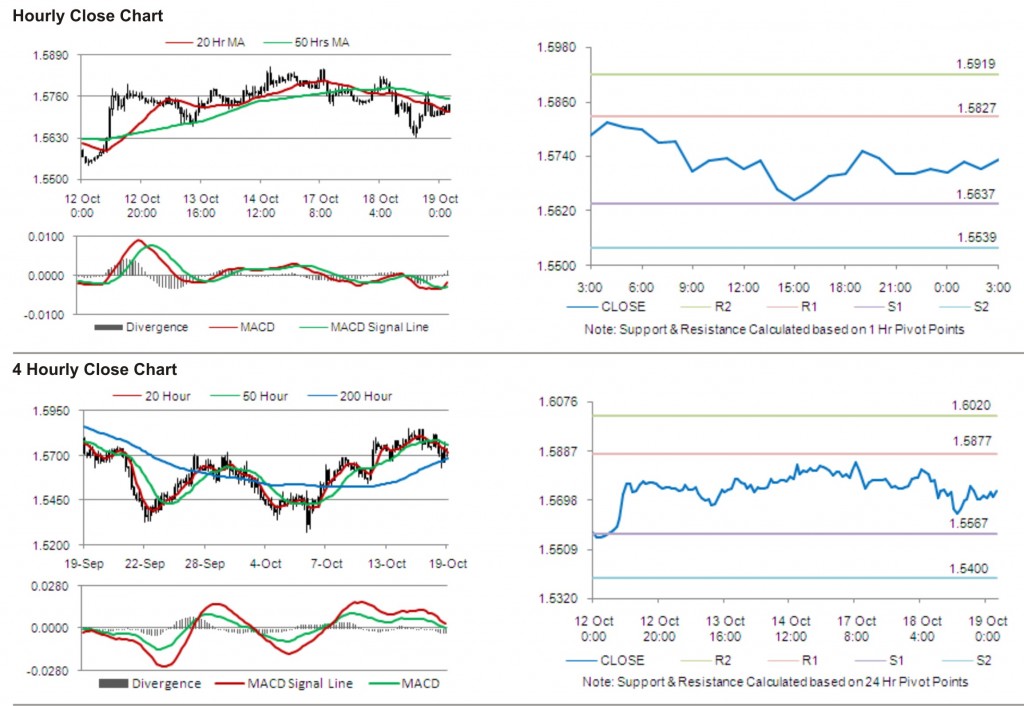

In the Asian session, at GMT0300, the pair is trading at 1.5734, with the GBP trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 1.5637, and a fall through could take it to the next support level of 1.5539. The pair is expected to find its first resistance at 1.5827, and a rise through could take it to the next resistance level of 1.5919.

Investors are eying BoE minutes to be released later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.