For the 24 hours to 23:00 GMT, EUR declined 0.60% against the USD on Friday and closed at 1.2891, amid concerns over Greece’s fiscal crisis, as Greek officials and private creditorsstruggle to reach agreement on a debt-swap deal.

Investors are waiting for Euro-zone ministers to decide later in the day what terms of a Greek debt restructuring they are ready to accept as part of a second bailout package for Athens, after negotiators for private creditors failed to agree on a debt swap deal.

Additionally, German Finance Minister, Wolfgang Schaeuble stated on Sunday that the crucial factor in negotiations over a debt-swap plan for Greece was that Athens should by 2020 have a sustainable level of borrowing.

Meanwhile, on the economic front, German producer price inflation advanced to 5.7% (YoY) in 2011, marking the fastest increase since 1982, while the French leading economic index fell to 112.5 in November.

In the Asian session, at GMT0400, the pair is trading at 1.2891, with the EUR trading flat from Friday’s close.

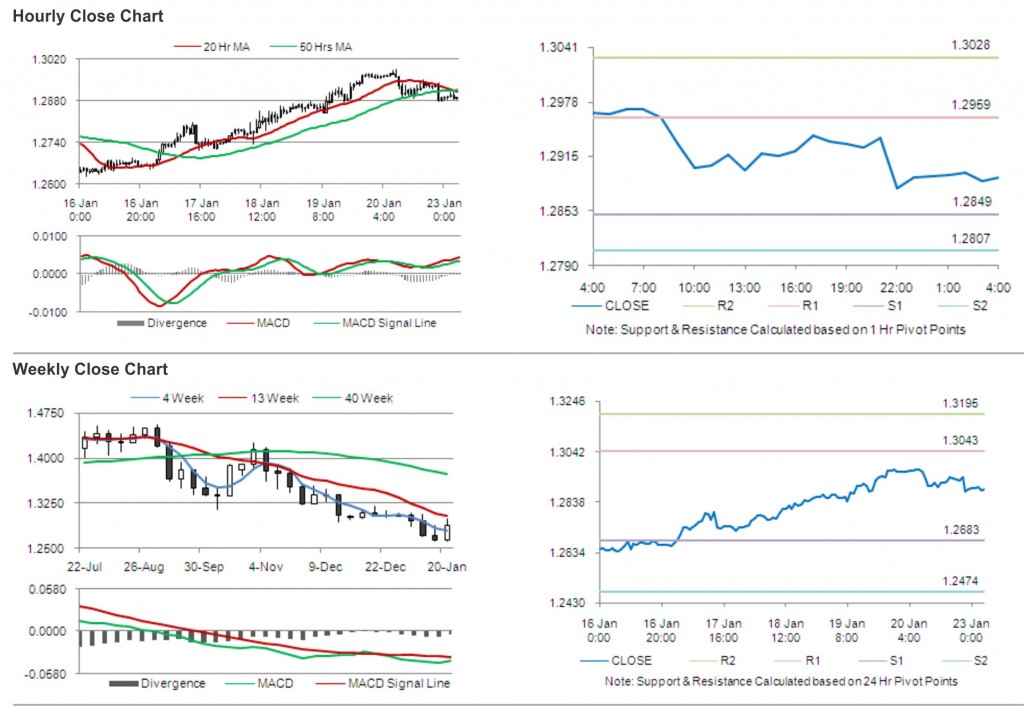

The pair is expected to find support at 1.2849, and a fall through could take it to the next support level of 1.2807. The pair is expected to find its first resistance at 1.2959, and a rise through could take it to the next resistance level of 1.3028.

Trading trends in the pair today are expected to be determined by the release of Euro-Zone consumer confidence later today.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.