For the 24 hours to 23:00 GMT, the EUR declined 2.08% against the USD and closed at 1.1366, after the ECB announced its highly-anticipated decision to implement quantitative easing.

Yesterday, the ECB Chief, Mario Draghi, stated that the central bank will purchase €60 billion per month worth of securities, including investment grade sovereign bonds, beginning in March and currently scheduled to last until September of 2016. He further added that these purchases would continue until there was a sustained improvement in the region’s inflation. Furthermore, he revealed that policymakers expect inflation in the region to average at 0.7% this year and 1.3% in 2016. Additionally, the ECB kept its interest rate steady at 0.05%, at par with market expectations.

In other economic news, the preliminary consumer confidence index in the Euro-zone registered a rise to a level of -8.50 in January, compared to market expectations of a rise to a level of -10.50. The index had registered a reading of -10.9 in the prior month.

Elsewhere, in Spain, unemployment rate climbed unexpectedly to a level of 23.7% in 4Q 2014, higher than market expectations of a drop to 23.5%.

In the US, number of people claiming unemployment benefits for the first time dropped to 307.0 K, less than market expectations of a fall to a level of 300.0 K. Initial jobless claims had registered a revised level of 317.00 K in the prior week. The nation’s housing price index rose 0.8%, higher than market expectations for a rise of 0.3% and compared to a revised advance of 0.4% registered in the prior month. Meanwhile, the Kansas City Fed manufacturing activity index fell unexpectedly to -2.00 in January, compared to market expectations of a steady reading. The manufacturing activity index had recorded a level of 8.00 in the previous month.

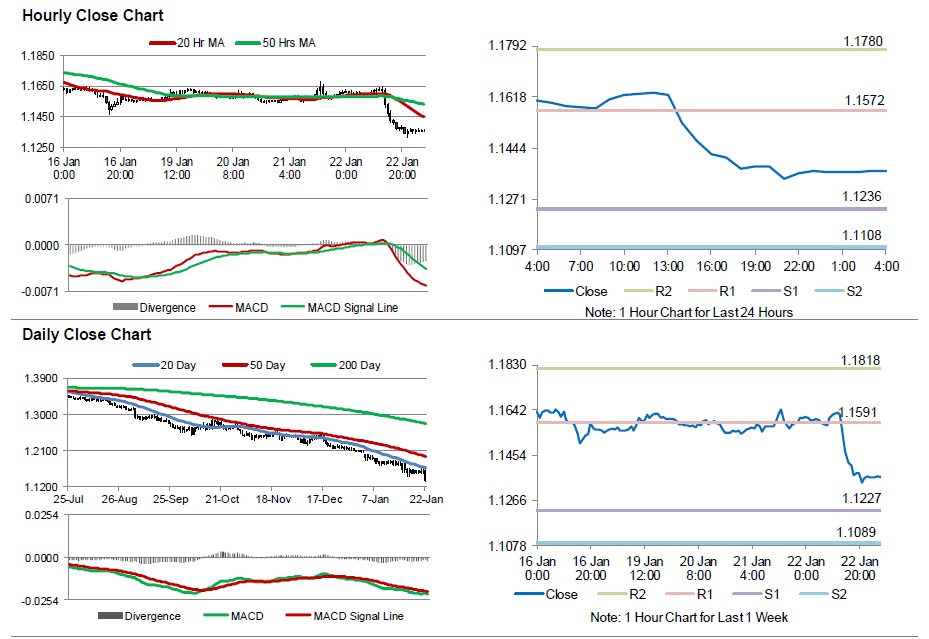

In the Asian session, at GMT0400, the pair is trading at 1.1364, with the EUR trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.1236, and a fall through could take it to the next support level of 1.1108. The pair is expected to find its first resistance at 1.1572, and a rise through could take it to the next resistance level of 1.1780.

Trading trends in the Euro today are expected to be determined by the manufacturing and services PMI data from the Euro-zone and its peripheries.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.