For the 24 hours to 23:00 GMT, the GBP fell 0.84% against the USD and closed at 1.5014, after the public sector net borrowing unexpectedly registered a surplus of £12.50 billion in December, following a revised surplus of £11.70 billion in the previous month, while markets were expecting it to drop to £9.00 billion.

In other economic news, the CBI trends selling prices fell to a level of -6.0 in January, compared to a level of 7.0 in the previous month

Separately, the BoE’s policy maker, David Miles, stated that though the inflation has slowed down recently, there was no urgency to add more monetary stimulus to the UK economy as it remains far from the deflation trap.

In the Asian session, at GMT0400, the pair is trading at 1.5013, with the GBP trading a tad lower from yesterday’s close.

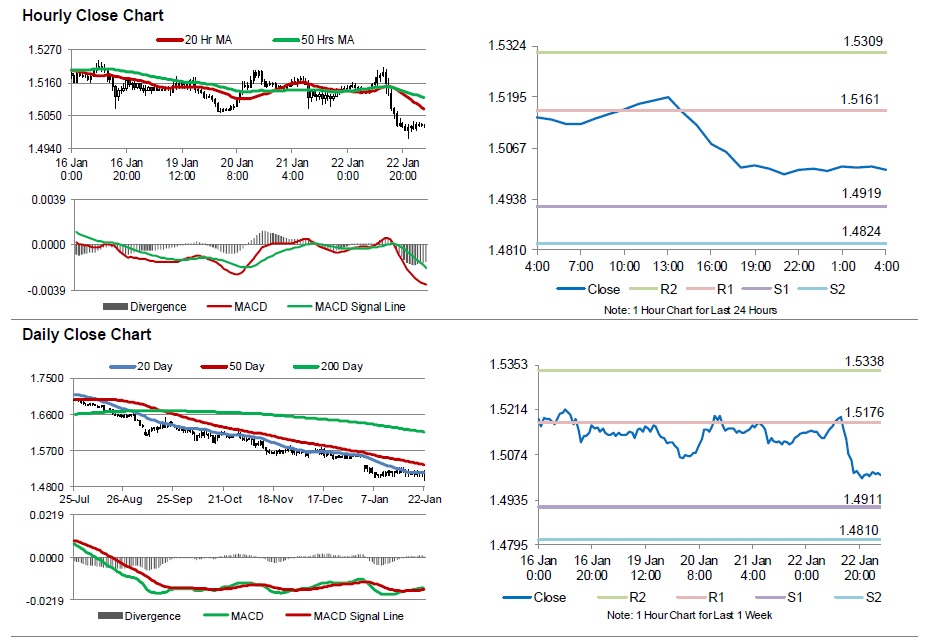

The pair is expected to find support at 1.4919, and a fall through could take it to the next support level of 1.4824. The pair is expected to find its first resistance at 1.5161, and a rise through could take it to the next resistance level of 1.5309.

Trading trends in the Pound today are expected to be determined by the UK’s retail sales data, scheduled in few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.