For the 24 hours to 23:00 GMT, EUR rose 0.44% against the USD and closed at 1.3853. The US Dollar lost ground after the minutes from the Fed’s March 18-19 policy meeting indicated that the central bank would be very cautious in raising its interest rates in the foreseeable future and would not be as soon as the market expected. The minutes also revealed that “all but one” Fed official noted that it would be “appropriate to wait until 2015 or later” to commence hiking short-term interest rates. Additionally, policymakers unanimously agreed to scrap its 6.5% unemployment threshold for raising interest rates, saying that it was “outdated” and should be removed. Meanwhile, the Chicago Fed President, Charles Evans urged the US Fed to keep its interest rate low for a longer period of time to help address the problem of low inflation in the economy. Separately, citing uncertainty over the slackness in the US jobs markets, the Fed Governor, Daniel Tarullo, urged policymakers to proceed cautiously in judging when inflationary pressures are building in the economy. However, at the same time, he commended the impact of the Fed’s unconventional monetary policy on the nation’s recovery and noted that economy remains well-rounded in future.

In the Euro-zone, an ECB policymaker, Josef Bonnici indicated that a further appreciation in the Euro would compel the ECB to undertake measures, including an asset-purchase programme to contain it.

The Euro came under pressure for a brief period of time, after data from Euro-zone’s largest economy, Germany showed that its trade surplus unexpectedly narrowed to a seasonally adjusted €15.7 billion in February, hurt by a drop in the nation’s exports and a surge in imports.

In the Asian session, at GMT0300, the pair is trading at 1.3850, with the EUR trading tad lower from yesterday’s close.

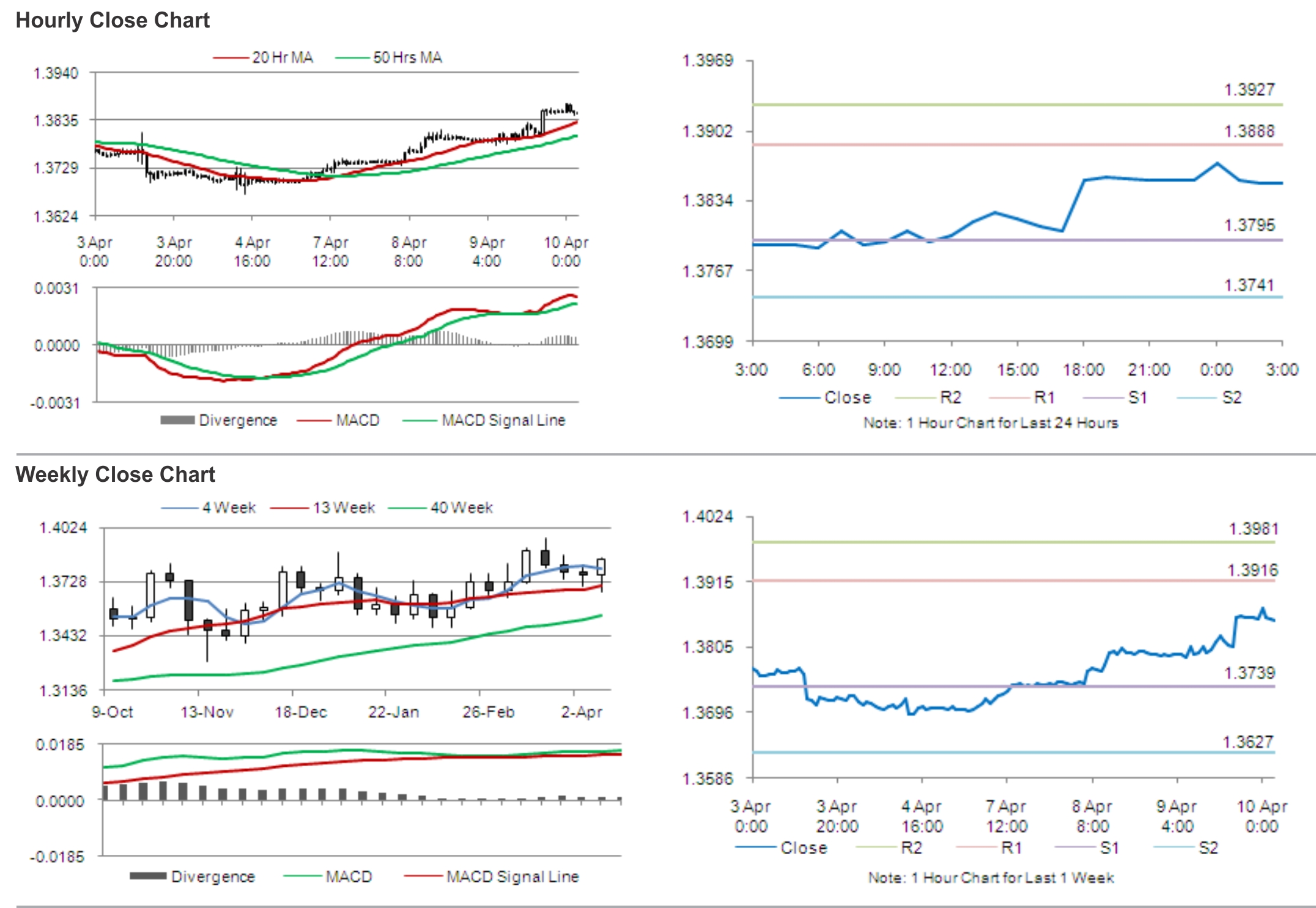

The pair is expected to find support at 1.3795, and a fall through could take it to the next support level of 1.3741. The pair is expected to find its first resistance at 1.3888, and a rise through could take it to the next resistance level of 1.3927.

Traders are expected keep a tab on the ECB’s monthly report, which would provide an insight into the prevailing economic situation and the risks to price stability in the Euro-zone economy. Meanwhile, the US monthly budget statement to be released later during the day would summarise the financial activities of federal entities, disbursing officers and Federal Reserve banks along with a report of deficit or surplus held by the US government

The currency pair is trading above its 20 Hr and 50 Hr moving averages.