For the 24 hours to 23:00 GMT, GBP rose 0.32% against the USD and closed at 1.6801, after an official data showed that total trade deficit in the UK narrowed more-than-expected to £2.06 billion in February, compared to a revised deficit of £2.20 billion recorded in the previous month. However, overall imports in the Britain economy dropped 2.2% (MoM) while exports of goods slipped 1.6% to £23.5 billion, the lowest level since November 2010.

In the Asian session, at GMT0300, the pair is trading at 1.6797, with the GBP trading marginally lower from yesterday’s close, ahead of the BoE’s interest rate decision scheduled later today.

Earlier today, the Royal Institution of Chartered Surveyors (RICS) reported that house prices in the UK unexpectedly rose to a level of 57.0% in March and number of homes for sale reached a six-year high to 22.7 in March.

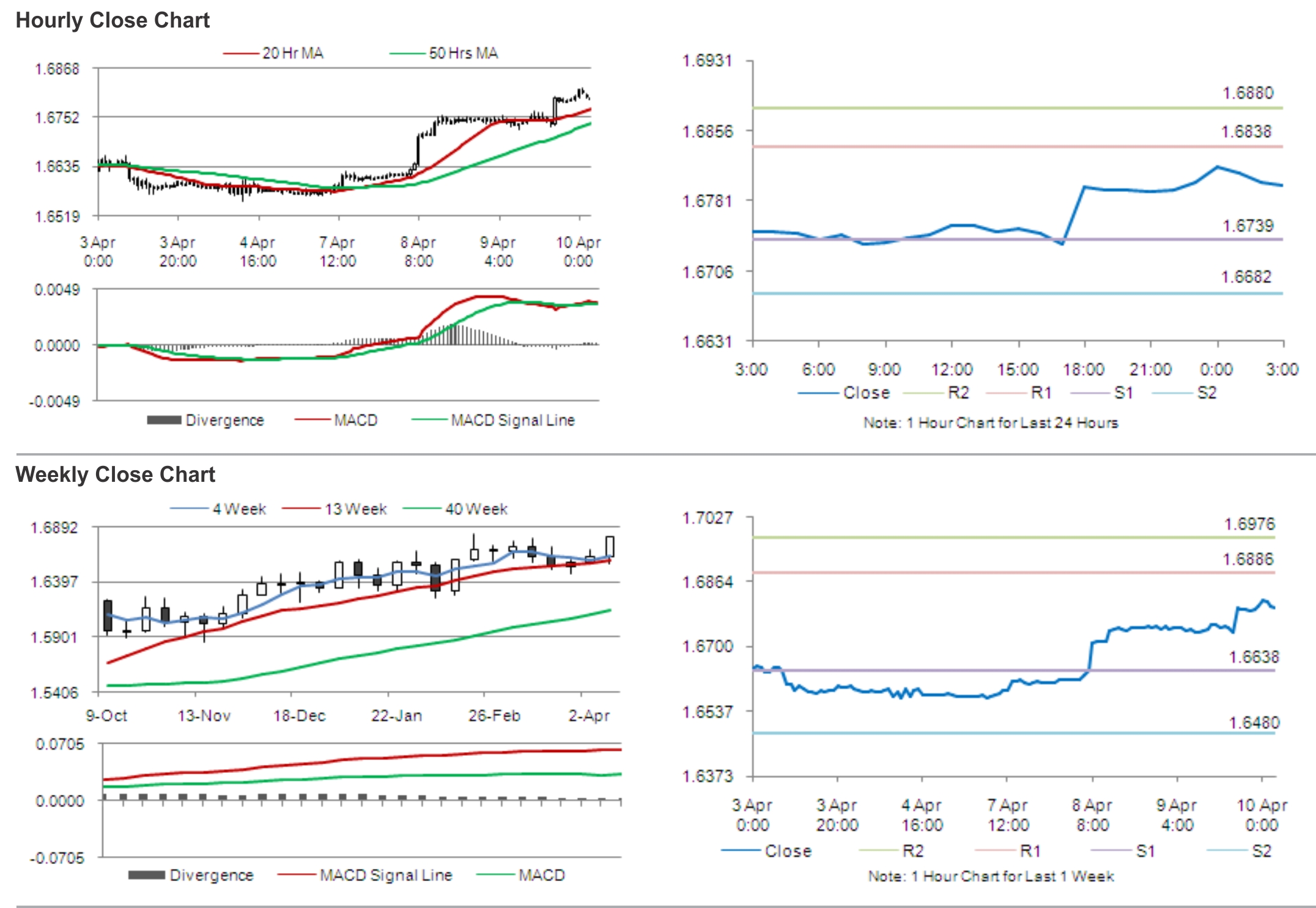

The pair is expected to find support at 1.6739, and a fall through could take it to the next support level of 1.6682. The pair is expected to find its first resistance at 1.6838, and a rise through could take it to the next resistance level of 1.6880.

Market participants keenly await the Bank of England’s (BoE) decision on interest rate and asset purchase facility, due later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.