For the 24 hours to 23:00 GMT, the EUR rose 0.66% against the USD and closed at 1.2532, after the ZEW reported upbeat economic sentiment data registered by the Euro-zone and Germany.

The ZEW’s index of German economic sentiment surged to 11.5 in November, registering its first rise since December 2013, beating expectations of an advance to 0.5 and compared to a level of -3.6 recorded in the previous month. Additionally, the ZEW’s index of the Euro-zone economic sentiment increased to 11.0 in November from 4.1 in October, thus raising hopes of an improvement in the Euro-economy. Meanwhile, Germany’s current situation index surprisingly rose to 3.3 in November, compared to market expectations of a drop to 1.7. The index had recorded a level of 3.2 in the preceding month.

Elsewhere, in Italy, current account surplus narrowed to €0.64 billion, after registering a current account surplus of €2.31 billion in the prior month.

Separately, the ECB’s Governing Council Member, Klaas Knot mentioned that the central bank would not hesitate from using additional quantitative easing measures if required, including purchases of government bonds.

In the US, the housing market index surprisingly gained to 58.0 in November, higher than market expectations of a rise to a level of 55.0 and compared to a reading of 54.0 recorded in October. Meanwhile, monthly producer price unexpectedly rose 0.2% in October, following a drop of 0.1% registered in September, while markets were anticipating it to fall 0.1%. On the other hand, the seasonally adjusted US Redbook index slid 0.9% on a monthly basis in the week ended November 14, after registering a decline of 1.0% in the previous week.

Yesterday, the Minneapolis Fed President, Narayana Kocherlakota, reiterated that any increase in interest rates in 2015 would be an “inappropriate” move, stating that it was unlikely that inflation could improve enough to support a rate hike in 2015.

In the Asian session, at GMT0400, the pair is trading at 1.2517, with the EUR trading 0.12% lower from yesterday’s close.

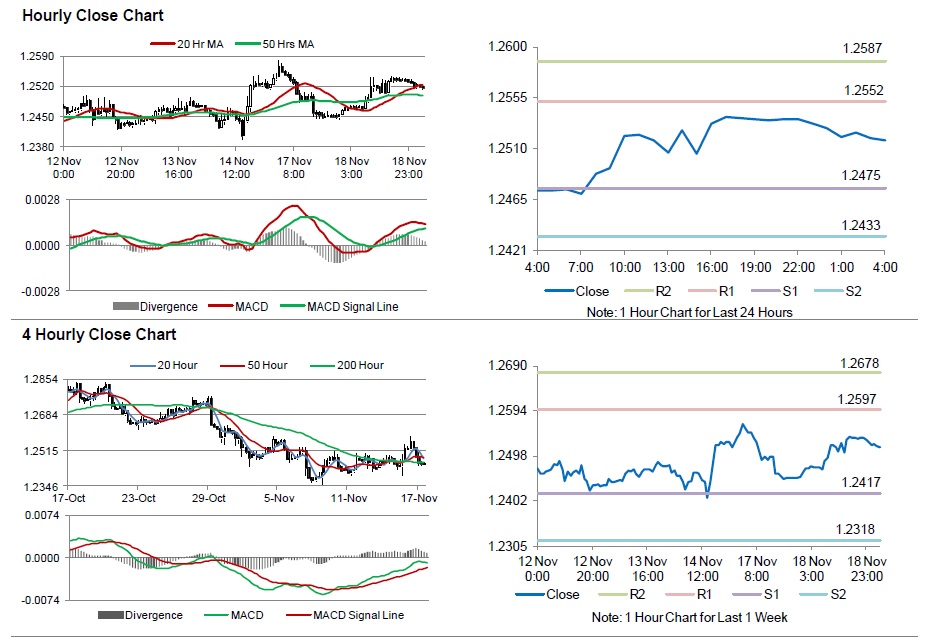

The pair is expected to find support at 1.2475, and a fall through could take it to the next support level of 1.2433. The pair is expected to find its first resistance at 1.2552, and a rise through could take it to the next resistance level of 1.2587.

Trading trends in the pair today are expected to be determined by the FOMC minutes from its latest monetary policy meeting, scheduled later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.