For the 24 hours to 23:00 GMT, the GBP fell 0.06% against the USD and closed at 1.5627.

In economic news, the UK monthly consumer prices advanced 0.1% in October, compared to a flat reading registered in the prior month. Markets were expecting it to rise 0.1% in October. Meanwhile, the nation’s ONS house price index recorded a rise of 12.10% on an annual basis, compared to a rise of 11.70% in the prior month, while markets anticipated it to climb 11.20%.

On the other hand, the UK’s producer price index core output unexpectedly rose 0.1% on a monthly basis in October, compared to a drop of 0.10% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.5608, with the GBP trading 0.12% lower from yesterday’s close.

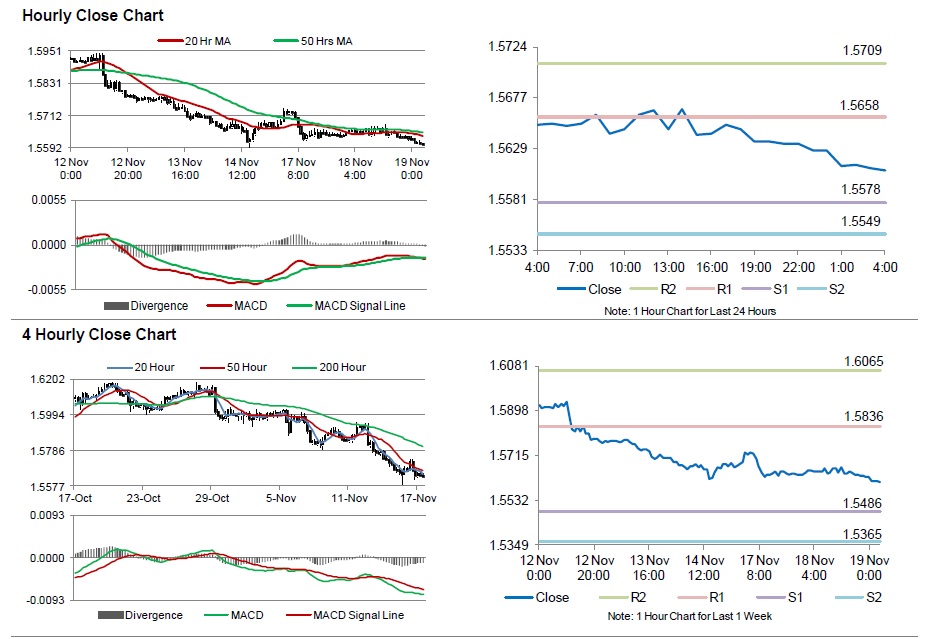

The pair is expected to find support at 1.5578, and a fall through could take it to the next support level of 1.5549. The pair is expected to find its first resistance at 1.5658, and a rise through could take it to the next resistance level of 1.5709.

Going forward, investors will eye the minutes of the latest BoE’s policy meeting to gauge the central bank’s views on the future course of interest rates, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.