For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.2432, after the ECB Chief, Mario Draghi stated that the central bank stands ready to take further unconventional policy actions, if the region’s medium-term inflation expectations weakened further. He further reiterated that interest rates in the common-currency bloc would remain at ultra-low levels for a long-term period.

In other economic news, the seasonally adjusted industrial production in the Euro-zone rebounded 0.6% on a monthly basis in September, lower than market expectations to advance 0.7% and compared to a revised decline of 1.4% registered in the previous month.

Elsewhere, in Germany, the wholesale price index eased 0.6% on a monthly basis in October, higher than market expected drop of 0.4%. It had risen 0.1% in the previous month.

Meanwhile, yesterday the OECD emphasised that the global economies were expanding at a stable momentum, however the Euro-zone economy continued to lose ground, particularly the German and Italian economy.

In the US, wholesale inventories advanced 0.3% in September, higher than market expectations for a rise of 0.2% and compared to a revised rise of 0.6% recorded in the prior month. Meanwhile, the nation’s mortgage applications fell 0.9% on a weekly basis, in the week ended 07 November 2014, after falling 2.6% in the prior week.

Separately, the Philadelphia Fed President, Charles Plosser mentioned that the Fed should raise interest rates sooner rather than later, citing that the US economy was making considerable progress towards achieving the central bank’s inflation and employment goals.

On the other hand, Minneapolis Fed President, Narayana Kocherlakota, reiterated his earlier stance that raising interest rate in 2015 would be inappropriate, citing a fragile nature of the US economic recovery.

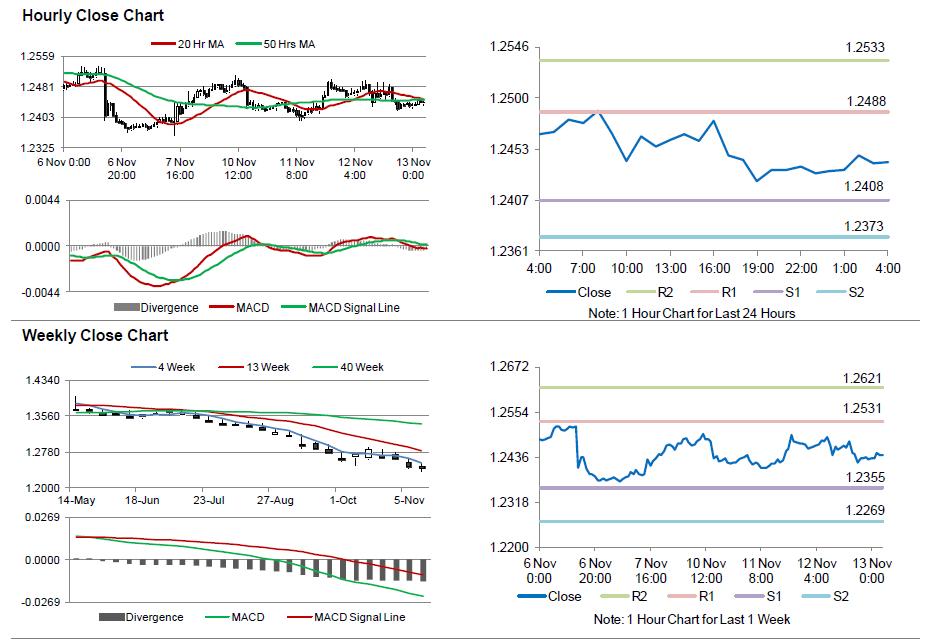

In the Asian session, at GMT0400, the pair is trading at 1.2442, with the EUR trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 1.2408, and a fall through could take it to the next support level of 1.2373. The pair is expected to find its first resistance at 1.2488, and a rise through could take it to the next resistance level of 1.2533.

Trading trends in the Euro today are expected to be determined by Germany’s crucial CPI data, set for release in a few hours. Meanwhile, investors would keep a close eye on the US initial jobless claims data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.