For the 24 hours to 23:00 GMT, the GBP fell 0.96% against the USD and closed at 1.5767, after the BoE in its recent quarterly inflation report forecasted Britain’s inflation rate to fall below 1.0% in the first quarter of 2015 and further stated that the inflation rate could remain below the central bank’s target of 2% for the next three years. It also slashed the nation’s GDP estimates and projected it to rise 3.4% in 2014, 2.7% next year and 2.6% in 2016, thus further pushing back expectations of a first interest rate hike by the BoE.

The Pound was further weighed down after UK’s ILO unemployment rate unexpectedly rose to a level of 6.0% in the three months ended September, failing to drop for the first time since the start of 2014, compared to market expectations of a drop to a level of 5.9%. Additionally, the nation’s claimant count rate remained unchanged at a level of 2.8% in October, while markets were expecting it to ease to a level of 2.70%. Meanwhile, Britain’s annual average weekly earnings for the July-September period surprisingly climbed 1.0%, beating market expectations for a gain of 0.8% and following a 0.7% increase registered in the prior three-month period.

On the other hand, Britain’s CB leading economic index slid 0.40% in September, after recording a rise of 0.40% in the prior month.

In a news conference after the release of the BoE’s inflation report, the central bank’s Governor, Mark Carney stated that he was not in favour of monetising UK’s debt anymore and further opined that the BoE should start unwinding its £375 billion asset purchase program eventually.

In the Asian session, at GMT0400, the pair is trading at 1.5774, with the GBP trading a tad higher from yesterday’s close.

Early morning data indicated that, the UK’s RICS house price balance climbed 20% in October, following a rise of 30% in the previous month. Markets were expecting it to fall 25% in October.

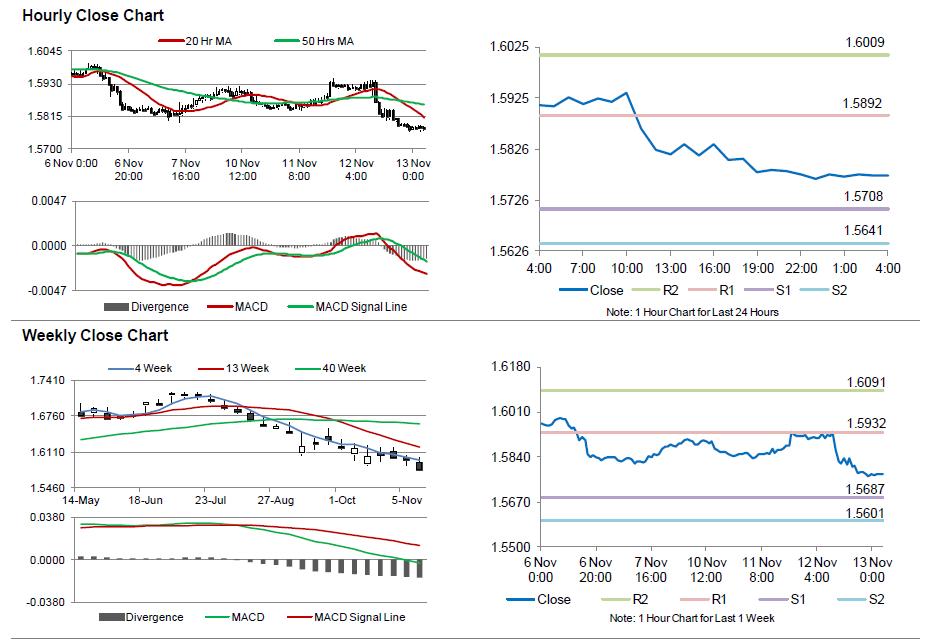

The pair is expected to find support at 1.5708, and a fall through could take it to the next support level of 1.5641. The pair is expected to find its first resistance at 1.5892, and a rise through could take it to the next resistance level of 1.6009.

Amid no economic releases from the UK today, market sentiments would be governed by global macroeconomic news.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.