For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.2684, after German exports tumbled 5.8% on a monthly basis in August, marking its biggest decline since January 2009 and higher than market expected drop of 4.0%. Additionally, the nation’s trade surplus narrowed to €14.1 billion in August, after registering a revised trade surplus of €23.5 billion in July.

Separately, the ECB Chief, Mario Draghi stated that he expects bank lending in the Euro-zone to pick up pace early next year and assured that the central bank would successfully boost inflation levels from its ultralow levels. He further mentioned that the ECB was willing to take additional monetary stimulus measures, if needed. Meanwhile, the ECB in its monthly report indicated that the new measures would support specific market segments and would play a key role in the financing the economy as well as increasing inflation back to its 2% target.

The IMF Managing Director, Christine Lagarde raised concerns over the Euro-zone possibly falling back into recession unless all the Euro-countries and the ECB don’t step up and take necessary actions to prevent it.

In the US, initial jobless claims unexpectedly fell to 287.0 K in the week ended October 4, lower than market expectations of a rise to a level of 294.0 K and compared to a revised level of 288.0 K registered in the prior week. Similarly, continuing claims dropped to 2381.0 K in the week ended September 27, compared to a revised reading of 2402.0 K recorded in the previous week.

The St Louis Fed President, James Bullard stated that there is a mismatch between the central bank’s thought process about monetary policy and the view held by the market, regarding the Fed’s intentions on interest rates.

Separately, the Fed’s Vice Chairman, Stanley Fischer mentioned that the central bank has identified areas of concern regarding economic stability and that the Fed was evaluating the strength in the greenback in context of its overall effect on demand for the goods and services produced by the nation.

Yesterday, the San Francisco Fed President John Williams indicated that the Fed would likely raise its interest rates in mid 2015 and further mentioned that lifting the key federal funds rate was dependent on continued economic improvement and the final decision will be “data-driven, not date-driven.”

In the Asian session, at GMT0300, the pair is trading at 1.2695, with the EUR trading 0.09% higher from yesterday’s close.

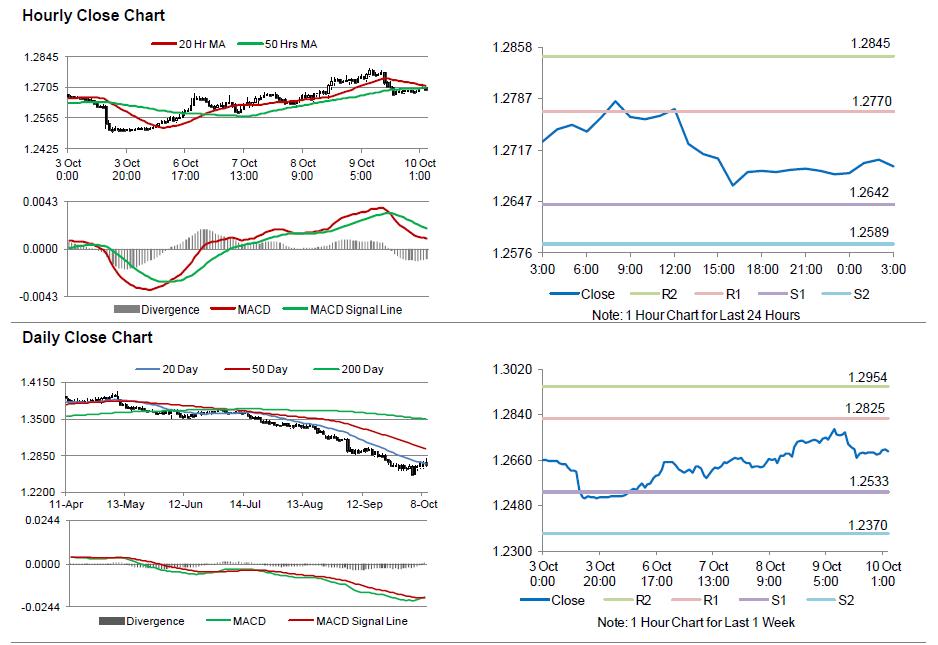

The pair is expected to find support at 1.2642, and a fall through could take it to the next support level of 1.2589. The pair is expected to find its first resistance at 1.277, and a rise through could take it to the next resistance level of 1.2845.

Amid lack of major economic releases from the Euro-zone today, investor sentiments would be governed by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.