For the 24 hours to 23:00 GMT, the USD weakened 0.23% against the JPY and closed at 107.91.

In economic news, Japan’s machine tool orders rose 34.8% on an annual basis in September, after advancing 35.5% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 107.89, with the USD trading a tad lower from yesterday’s close.

The BoJ in its latest minutes revealed that the policymakers unanimously agreed to keep its interest rates at 0.1% and that the monetary base will increase at an annual pace of ¥60-70 trillion. It also indicated that the Japanese economy continues to recover moderately, as the labour market and wages have improved.

Overnight data indicated that the tertiary industry index in Japan unexpectedly dropped 0.1% on a monthly basis in August, lower than market expectations for a rise of 0.1% and compared to a revised drop of 0.3% recorded in July.

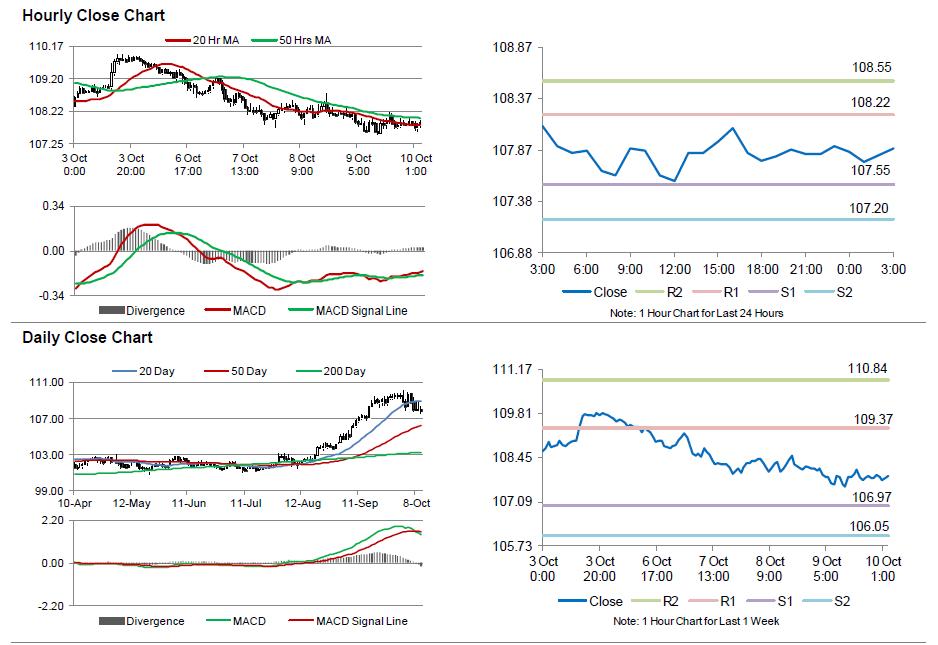

The pair is expected to find support at 107.55, and a fall through could take it to the next support level of 107.20. The pair is expected to find its first resistance at 108.22, and a rise through could take it to the next resistance level of 108.55.

Trading trends in the Yen today would be determined by Japan’s consumer confidence data, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.