For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.2492, after manufacturing activity in Germany, the Euro-zone’s biggest economy expanded less than expected to 51.4 in October, against market expectations for a rise to a level of 51.8 and compared to a similar preliminary reading.

Similarly, in the Euro-zone, manufacturing PMI advanced to 50.6 in October, down from preliminary reading of 50.7.

Elsewhere, in France and Italy, manufacturing activity in October remained in the contraction territory.

Yesterday, the ECB’s Governing Council Member, Ewald Nowotny spoke to a newspaper that the central bank needs to be cautious about buying government bonds from the Euro-countries.

The greenback traded on a higher ground after the US ISM manufacturing PMI unexpectedly increased to 59.0 in October, marking the highest pace of expansion since March 2011, higher than market expectations to ease to 56.1 and following a level of 56.6 registered in the previous month. However, the nation’s constructing spending unexpectedly fell 0.4% on a monthly basis in September, compared to market expectations for a rise of 0.7%. It had registered a revised drop of 0.5% in August. Additionally, the ISM prices paid index recorded a drop to 53.5, compared to market expectations of a fall to a level of 58.0 and after registering a reading of 59.5 in the previous month. Meanwhile, the US Markit manufacturing PMI came in at 55.9 in October, lower than market expectations to rise to a level of 56.2.

Separately, the Dallas Fed President, Richard Fisher, stated that a slightly hawkish tone of the last week’s policy statement prompted him to vote in favour of the October Open Market Committee statement.

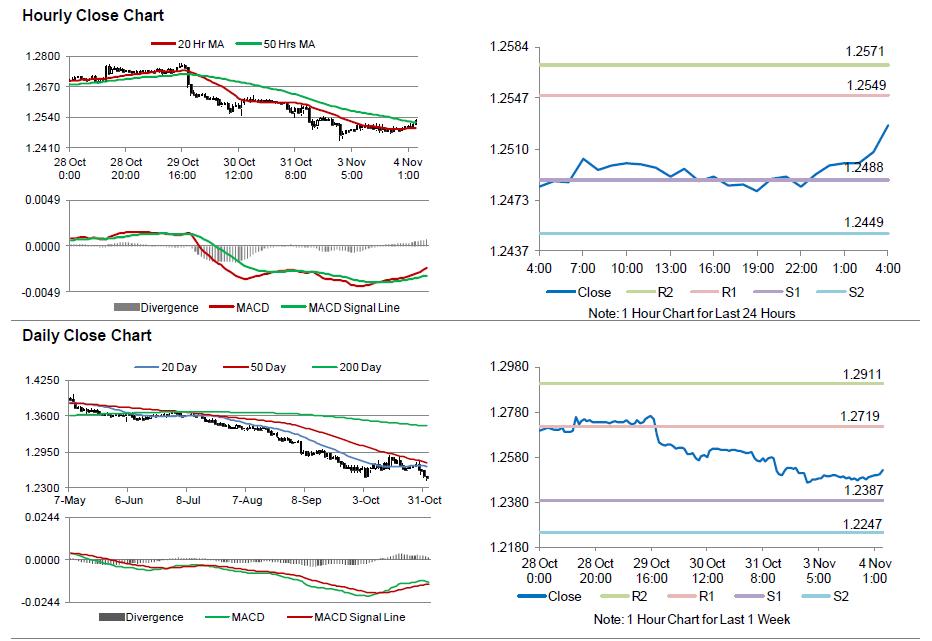

In the Asian session, at GMT0400, the pair is trading at 1.2527, with the EUR trading 0.28% higher from yesterday’s close.

The pair is expected to find support at 1.2488, and a fall through could take it to the next support level of 1.2449. The pair is expected to find its first resistance at 1.2549, and a rise through could take it to the next resistance level of 1.2571.

Trading trends in the Euro today are expected to be determined by the European Commission’s economic growth forecast data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.